The business case for high-performance lubricants

Mike Johnson, Contributing Editor | TLT Best Practices December 2011

This seven-point analysis answers the only question that counts: Can you make money using them?

KEY CONCEPTS

•

Conventional-performance lubricants deliver above the minimum allowable technical specifications and are priced to earn the sale.

•

High-performance products thoroughly exceed the minimum allowable technical standard for a given application.

•

A thorough business-considerations analysis can help you decide which machines are the best fit for the high-performance product line.

PRICE VERSUS PERFORMANCE

The May 2010 article showed how one can achieve better business economy through better lubricant quality. Machine mechanical reliability starts with machine lubrication—for better or worse, no other aspect of the routine maintenance plan has the same degree of impact on machine reliability.

Given the great number of lubricant marketers relentlessly and effectively promoting an enormous variety of highly similar looking lubricants, it is not surprising that for most lubricant users the discussion about what makes machine lubrication effective revolves around brand and lubricant type selection. Further, most brands provide a premium and a conventional product line, and the sales pitches from competitive brands are surprisingly similar: buy Brand X—the best performance for the price! These sales characteristics not withstanding, there are substantial differences between brands and their products. There are both superior and inferior options available, and the prices for the products tend to follow the relative quality.

To differentiate in general terms,

conventional-performance lubricants meet the “keep it full” requirement. These products are built to deliver above the minimum allowable technical specifications. The performance is measured, results are published and the products are priced to earn the sale. This model represents how most manufacturers (machine owners) procure lubricants, and accordingly the model serves the dominant market interest.

High-performance products are designed to thoroughly exceed the minimum allowable technical standard for a given application. They are manufactured with specialized raw materials for proprietary, sometimes patented, lubricant recipes. The materials are designed to offer enhanced performance capability in the form of improved oxidation and deposit resistance, improved surface protection (wear resistance, nanoscale surface enhancement), improved long-term viability (greases), etc., versus conventional product performance. Given that the cost of raw materials varies with raw material performance capability, it is inevitable that the finished product cost basis and market price will be higher.

Given this characteristic, how does the end-user take maximum advantage of both price and performance aspects of the supply line?

A VALUE-BASED SELECTION

As a consequence of a busy training schedule, I am often invited by frontline supervisors and their lube technicians to review what is actually happening with lubrication in the manufacturing plant (compared to what senior management believes is occurring). Time and time again I witness misapplications, both where a high-performance (HP) lubricant should be used and where it shouldn’t. In my opinion, there is a problem with over application of HP lubricants, mostly due to the selection of synthetic-based products to perform work that petroleum-based products are better suited to accomplish.

The problem occurs from over dependence on the local supplier representative to make a wholly benevolent, purely customer-centric, decision. To be clear, this isn’t a lube-brand problem. There are both privateers and entirely trustworthy people working at all levels of all companies, including lubricant suppliers. It would be best for the company to have an objective, machine-specific basis for upgrading from a low-value product to a high-value option.

All production machines in a facility should be ranked from most to least important to the production mission.

All production machines in a facility should be ranked from most to least important to the production mission.

www.canstockphoto.com

Here is a set of seven questions that the reliability engineer can use to create an objective basis for making a business-balanced decision.

1.

Is the machine’s mission and criticality clearly defined?

2.

Is the machine sufficiently productive for current and future requirements?

3.

Is the machine operating within the OEM’s recommended parameters?

4.

Is there a clearly definable expectation for change in the machine’s performance based on a lubricant change?

5.

Can the change in machine performance be objectively measured and quantified?

6.

Can the expected improvement characteristic from within the lubricant be objectively measured?

7.

Are there any intangible benefits that enhance the upgrade value proposition?

Let’s take a closer look at these seven questions.

1. Is the machine’s mission and criticality clearly defined or definable? This question should sit at the top of any list of actions for reliability improvement. The argument for creating a priority structure was provided in the June 2011

Best Practices article (available digitally at

www.stle.org). All production machines in a facility should be ranked from most to least important to the production mission. The top 20%-30% arguably are the most valuable to the organization. If one is to consider upgrades to machines, it makes economic sense to consider changes that increase the productivity of the most important machines in the operation. Conversely, upgrading material quality for those machines that are only marginally significant to the organization is a waste of both time and money.

2. Is the machine sufficiently productive? This raises the question of how to measure machine productivity. Productivity is a combination of production volume and quality. If a machine is always available (great dependability) but never delivers products that can be sold (poor quality), then its value to the organization is low. Similarly, if it produces high-quality goods but is rarely available to produce these goods, then again its value is low.

One of the common performance indicators for machine productivity is OEE or Overall Equipment Effectiveness. It is a widely used basis for the measure of how effectively a machine meets overall production requirements. It is based on a combination of the finished quality of produced goods, the machine’s availability to produce those goods and the performance rate (actual throughput divided by rated throughput) with which it produces goods. Each of these numbers is given a percentage value, and the three are multiplied to produce an OEE.

OEE = Availability x Performance x Quality

For instance, if the machine is available 85% of the time to run production, its rate of production is 85% of the design capacity, and 98% of throughput is shippable, then its OEE would be (.85 * .85 * .98 = ) .708 or 71%.

Questions 1 and 2 are at the front of this list for this reason: If the machine has high potential economic value but a low effectiveness rating, it is worth improving.

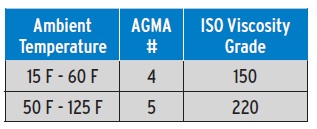

3. Is the machine operating within the OEM’s recommended parameters? This is the first direct point of consideration for lubricant selection. OEMs provide model-specific, generic lubricant recommendations for the expected operating parameters. For instance, it is common for the gear-drive manufacturer to have a viscosity rating for an operating temperature range that looks like this:

One first determines if the machine is operating at an ambient temperature within the projected range and then determines if the stipulated viscosity grade and additive type is in use. If the lubricant in use isn’t appropriate for the ambient temperature, this must first be corrected so that machine performance can be established for normal operating conditions.

If a machine has high potential economic value but a low effectiveness rating, it is worth improving.

If a machine has high potential economic value but a low effectiveness rating, it is worth improving.

www.canstockphoto.com

Next, the normal condition should be defined for component health as identified by lubricant analysis. To determine ‘normal’, a highly quality analysis program must be in place that satisfies the following criteria:

a.

Fixed sample ports that deliver repeatable samples, regardless of who is collecting the sample.

b.

An appropriate test slate is in place, including at least the following:

I.

Viscosity at 40 C.

II.

Wear Debris – small (via atomic spectrometry).

III.

Wear Debris – large (via PQ, DR Ferro or Rotrode Spectroscopy).

IV.

FTIR (oxidation, nitration, sulfation, lubricant health, moisture).

V.

Moisture (KF, based on positive from FTIR).

c.

A wear metals statistical alarm parameter, (+1Σ, +2Σ, +3Σ, +6Σ) derived from machine make and model-specific machines only (avoiding intermingling general mechanical wear data from other machines).

d.

A consistent and timely sample history.

Without a high data quality level, it isn’t rational to expect to determine what’s normal for machine wear debris generation. With clearly defined collection, testing and analysis parameters, it is relatively easy to make judgments about machine condition improvements surrounding lubricant changes, which brings us to Questions 4 and 5.

4. Is there a clearly definable expectation for change in the machine’s performance based on a lubricant change? If the machine has been set up for effective lubricant-based condition monitoring, and there is a clear pattern of component stress or failure, then the target for improvement is implied and well defined. If wear debris is demonstrated to be at a 3Σ level, then reducing wear to a 1Σ condition will be the obvious objective.

5. Can the change in machine performance be objectively measured and quantified? At a minimum, the same means used to identify an opportunity for improvement in machine performance through the use of superior lubricant properties will also be the primary mechanisms used for detecting improvement in the machine condition following a change. Outside of this best case evidence, there are at least five other particularly useful ways to measure for improvement in performance, including:

•

Thermal imaging

•

Noise (sound) level measurement

•

Ultrasound or compression wave measurement

•

Energy consumption

•

Vibration analysis.

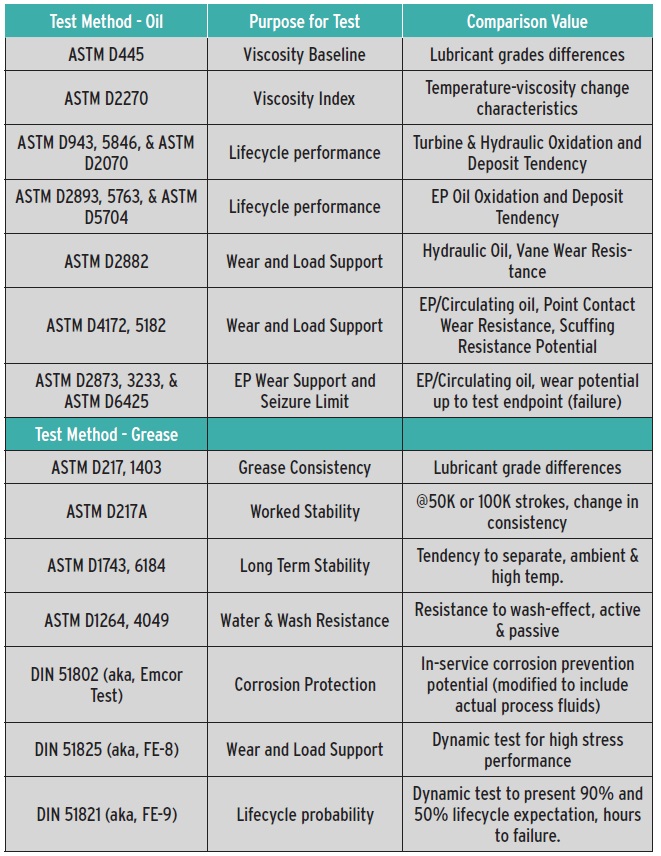

6. Can the expected improvement characteristic from within the lubricant be objectively measured? This is the lead point in the “can we prove improvement” discussion much of the time. There are a multitude of DIN, ISO and ASTM methods used to measure a wide variety of lubricant performance characteristics. The tests can be divided into either condition- or performance-based tests. The condition-based tests refer to those defining operating conditions and their influences (moisture, solid contaminant, wear debris characterization, degradation, etc.) and form the basis for routine machine and lubricant condition analysis. Performance-based tests are used to define the fluids’ critical properties and performance parameters (

1). Both types of tests may be used to draw a conclusion about differences in the lubricant’s capabilities to protect machine performance.

These tests are most effective when used to demonstrate a change in a given lubricant performance characteristic over time rather than when used to compare two products for effectiveness. Instrument and test hysteresis prevents formation of absolute results and immutable conclusions. Additionally, in nearly all instances the test itself does not simulate the operating characteristics of the production machinery applications. Comparisons can be drawn, and conclusions projected about what should happen, but the tests are rarely a true indicator of what

will happen.

Here are some commonly used tests for determining differences in lubricant performance under test conditions (

2, 3) (

see table below).

7. Are there any intangible benefits that enhance the upgrade value proposition?

7. Are there any intangible benefits that enhance the upgrade value proposition? This pertains to general business benefit considerations and either support or dissuade if the objective answers to the technical questions are not conclusive. These “soft” benefits can be numerous, such as:

•

Reduced vendor(s) participation

•

Reduced business transactions

•

Reduced net inventory

•

Consolidated product array

•

Reduced labor (and cost) from product use, such as from:

a.

Extended lifecycles

b.

Reduced fill cycles (top-ups, regrease)

c.

Reduced lubricant handling associated with reduced purchases and extended sump lifecycles

•

Improved general machine health assurance

•

Extended mechanical component capacity (increase speed, load, environmental complication)

•

Lower cost of insurance via improved machine durability

•

Improved employee safety/reduced risk of injury.

These may be clearly definable (reduced cost of insurance, reduced cost of labor, reduced net inventory) but secondary to reliability objectives, or they might only be perceived added benefits.

After all the considerations, the answer to the most important question should be evident: Can this company make money through the use of high-performance, higher-priced lubricants? This is really the only question that matters, but it is predicated on the questions about sustained, high quality output and should have little to do with the cost of the lubricant.

REFERENCES

1.

Toms, L.A. and Tom, A.M. (2006),

Handbook of Lubrication and Tribology, Section 30: Lubricant Properties and Test Methods. Volume 1 Application and Maintenance, Second Edition, CRC Press and STLE, p. 30-1.

2.

Standards on Petroleum Products and Lubricants, Volumes 05.01-05.04, ASTM (American Society of Testing and Materials),

www.astm.org.

3.

Deutsches Institut fur Normung e. V. (DIN).

www.normung.din.de.

Mike Johnson, CLS, CMRP, MLT II, MLA III, is the principal consultant for Advanced Machine Reliability Resources, in Franklin, Tenn. You can reach him at mike.johnson@precisionlubrication.com

Mike Johnson, CLS, CMRP, MLT II, MLA III, is the principal consultant for Advanced Machine Reliability Resources, in Franklin, Tenn. You can reach him at mike.johnson@precisionlubrication.com.