Recovery for Indian finished lubricant market?

Anuj Kumar Singh and Hareesh Nalam | TLT Market Trends March 2020

After recent setbacks, and buoyed by gains on the consumer side, modest growth is expected for the next five years.

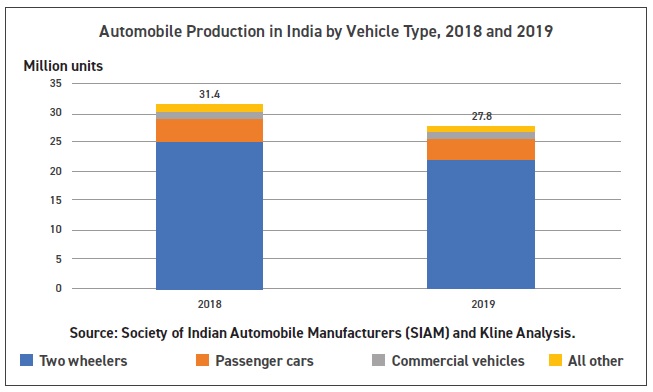

India’s automobile production contracted 10%-12% in 2019, with the most severe shrinkage in commercial vehicles.

The finished lubricant market growth story in India has fascinated many by its continued resilience amidst difficult times. During the last decade, when the global economy was reeling, India was one of the few markets not greatly impacted. Several factors helped India emerge unscathed from that crisis, including strong economic fundamentals, a growing middle class and increasing demand from the domestic market (which hedged it from shocks in export markets).

What followed was a period of consistently high growth. Naturally, the finished lubricant market benefitted from it and made India one of the fastest major lubricant-consuming markets in the world. Kline estimates that Indian finished lubricant demand has grown at a CAGR of around 1.8%-2.0% during the period between 2013 and 2019.

Signs of weakness

However, as we stand at the beginning of a new decade, the steam in the Indian economy seems to be fizzling. The Indian economy has registered continuous downward revisions in its economic growth. The latest estimates by International Monetary Fund (IMF) pegs the growth for the Indian economy at 4.8% for the fiscal year from April 2019 to March 2020, a sharp contrast to growth rates of around 8% year in the past.

Several structural changes were introduced in the past few years. Demonetization of its currency notes and implementation of goods and services tax (GST) which, in principle, are good for economic health, created some disruptions in the economy. Moreover, weakness of the non-banking financial sector, growing non-performing assets (NPAs) and reliance on rainfall for a good agricultural harvest have contributed to the woes of the Indian economy. As a result, the Indian finished lubricant market has been hit.

India is not only a big automobile market but also a big manufacturer as well. After a period of sustained growth, Indian automobile production and sales declined sharply in 2019. Automobile production contracted by 10%-12% with the most severe shrinkage observed in commercial vehicles production.

In addition, weakness in key industrial segments persisted. Index for Industrial Production (IIP), a key indicator reflecting the health of industries in India, remained low. Consequently, the Indian finished lubricant demand managed a meager growth of 0.5% in 2019 from 2018. This is a significant reduction compared to historical growth rates of around 2%.

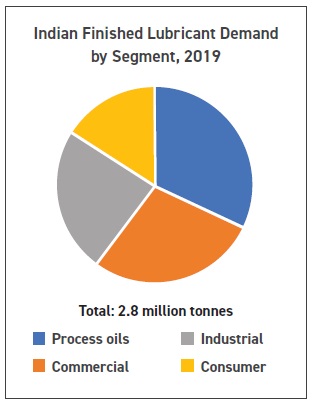

While the consumer segment (including passenger cars and two-wheelers) grew between 2.0% and 2.5% in 2019, the commercial segment (including commercial on-road and off-road vehicles and equipment) declined by around 0.5%. Demand for industrial lubricant registered minuscule growth. Overall, Kline estimates Indian finished lubricant demand at around 2.8 million tonnes including that for electrical transformer oils, white oils and rubber process oils.

Rapid lube market change

Rapid lube market change

While volumetric growth appears to have decelerated, India is making significant strides toward improving the quality of finished lubricants used. These changes are primarily driven to address the menace of air pollution and improve vehicles’ fuel efficiency.

One key change that will have a profound impact on the lubricant quality in the automotive segment is the introduction of Bharat Stage VI (BS VI) norms. These are equivalent to Euro VI norms. To meet these stringent norms, the role of lubricant becomes important, however small. In general, there will be an accelerated switch toward lighter viscosity grades of engine oils. Currently, most OEMs recommend SAE 5W grades for new vehicles with some of them even recommending SAE 0W grades for select variants.

A switch toward a lighter grade of lubricants is not only restricted in the engine oil category but is also apparent in transmission fluids. Until a few years back, SAE 80W-90 was the key grade used for factory fill and service fill by most passenger car manufacturers. However, to maximize the benefits of fuel economy, the use of lighter grades such as 75W-90 and 75W-85 has become prominent. Moreover, changing customer preference in the country is resulting in a surge in automatic variants of passenger cars. This trend is not only restricted in the premium car segment but has permeated to the mass market segment as well. Currently, automatic variants account for 10%-20% of new car sales for most OEMs in the country. This creates new demand for automatic transmission fluid, which is usually a synthetic lubricant.

On the commercial-vehicles side, compliance to BS VI is being targeted primarily with the help of hardware changes. However, a new market is opening for diesel exhaust fluid (DEF), which helps in scrubbing off harmful gases from exhaust before releasing them to the atmosphere. The market for DEF is currently small in India but will witness a steep growth in the coming years.

A key trend shaping the finished lubricant market in India is an extension in oil drain intervals. In the passenger car segment, the average recommended oil drain intervals are in the range of 10,000-15,000 kilometers. This has been a result of the growing proliferation of high-quality lubricants which are blended with Group II and III basestocks. Easy availability of basestock from nearby regions has helped the case.

Within the on-road commercial vehicles segment, average drain intervals have increased to 40,000-80,000 kilometers. Some OEMs recommend drain intervals upward of 80,000 for select models. SAE 15W-40 is the key viscosity grade, while API CI-4 Plus is the key API service category for engine oils used in commercial vehicles. The role of grades like SAE 10W-30 is small but growing.

A key feature of the Indian finished lubricant market is high demand for process oil products, which includes electrical transformer oil, white oils, and rubber process oils (RPO). These products account for close to one-third of the total finished lubricant demand. India is not only a key market for these products but a key exporter as well, serving markets in Africa, the Middle East, Southeast Asia and other parts of the world.

Several deliberations in the past have happened over formulating auto scrappage policy in India. At present there is no formal policy directing the life of a vehicle to be used. As a result, the average vehicle life in India is much longer than that in Western markets. There have been several recommendations made in the draft policy guidelines which, if implemented, will help improve the age profile of vehicles in India. As more newer vehicles are added to the population and older vehicles are scrapped, demand for better quality lubricant will grow. This will result in an accelerated decline in demand for older specification oils.

India’s economy is known for its resilience and often goes contrary to global trends.

India’s economy is known for its resilience and often goes contrary to global trends.

Agriculture is a major source of livelihood for a majority of the Indian population. With the growing mechanization of the sector, demand for finished lubricants has grown considerably. However, fortunes of the Indian agriculture sector are often contingent on rainfall each year, resulting in demand fluctuation from the sector.

Among the various industrial sectors, power (including both generation and distribution) is the major contributor to finished lubricants demand in India. The growth in industry, rapid urbanization and electrification of rural areas is resulting in sustained demand growth for products like transformer oil. Nonetheless, the country relies heavily on power gensets used as backup due to frequent power outages. These diesel-powered gensets typically use heavy-duty motor oils (HDMO) and contribute significantly to finished lubricant demand. Besides power, other notable end-use segments for finished lubricant demand include chemicals (including rubber processing), automobile manufacturing, auto components, general engineering, metals (both primary and fabricated) and mining.

Synthetic lubricants, although becoming increasingly popular in the consumer lubricant market, are a niche market in the commercial and industrial segment. Kline estimates that around a quarter of the consumer lubricant market is accounted for by synthetic and semisynthetic lubricants, while the penetration in commercial and industrial segments is less than 5%. The high cost of synthetic lubricants is a major impediment to the growth of synthetic lubricants. Their use on the industrial side is primarily driven by OEMs’ recommendations.

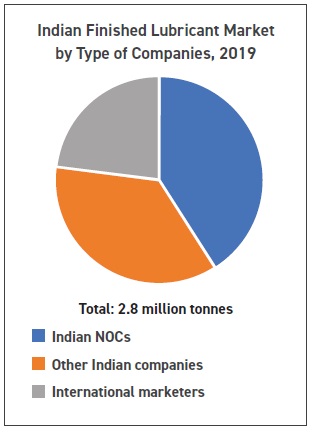

Being the third-largest finished lubricant market, it is natural that the Indian finished lubricant market is fiercely competitive. The market is characterized by the presence of the three nationalized oil companies (NOC): Hindustan Petroleum, Indian Oil and Bharat Petroleum; international oil companies including ExxonMobil, Shell, Valvoline, Total; and Indian companies including Gulf Oil, Tidewater Oil, Apar Lubricants and Savita. Overall, Hindustan Petroleum is the leading marketer of finished lubricants (including process oils), accounting for around 18% of the market share, followed by Indian Oil. However, in the additized lubricant market (excluding process oils), Indian Oil is the market leader, followed by Hindustan Petroleum.

An interesting trend in the Indian consumer lubricant market is the emergence of OEM genuine oils. These brands, owing to a strong brand image of the OEM company, have successfully established themselves in the market. The success of these OEM brands largely owes to the growing service network of OEMs. Moreover, these brands are also being sold in the retail market, and a strong brand image of OEM often helps them grow.

What lies ahead?

What lies ahead?

While the overall economic growth may have subdued in the last year, it is a general consensus that India soon will recover to its usual growth trajectory as structural changes and policy corrections start bearing results. In the short term, IMF projects that the Indian economy will recover to grow at 6.5% in 2020-2021. These rates are certainly lower than historical highs but instill the confidence of continued demand growth in the finished lubricant market.

Overall, Kline forecasts that finished lubricant demand will grow at a CAGR of around 1.5% over the period 2019-2024. The consumer lubricant market will grow the fastest, while demand growth from the commercial segment will be the slowest.

Despite the reduction in growth rates, India remains the fastest-growing major finished lubricant market. In the times when growth is elusive in key markets like the U.S., China and Western Europe, the Indian finished lubricant market offers growth opportunities to lubricant marketers. Due to a transition toward better finished lubricant quality, the market outlook in value terms is brighter than the market outlook in volumetric terms.

Hareesh Nalam is senior manager (Energy) and Anuj Kumar is project manager (Energy) for Kline & Co. You can reach them at hareesh.Nalam@Klinegroup.com and anuj.kumar@Klinegroup.com. Kline is an international provider of world-class consulting services and high-quality market intelligence for industries that include lubricants and chemicals. Learn more at www.klinegroup.com.