KEY CONCEPTS

•

The new IMO cap of 0.5% or less sulfur in marine fuel emissions goes into effect Jan. 1.

•

Fuel and lubricant formulators and suppliers are working hard to deal with both the restriction and its implications.

•

Ship owners have options to comply other than using lower-sulfur fuel.

Marine transport is involved in more than 90% of global trade. The sheer volume of goods and the immense territory it covers necessitates comprehensive oversight by a neutral entity. International Maritime Organization (IMO), the United Nations agency responsible for regulation, provides this function. Now, as IMO prepares to significantly tighten regulations on ship-source pollutants, fuel and lubricant formulators and suppliers are working diligently to accommodate restrictions.

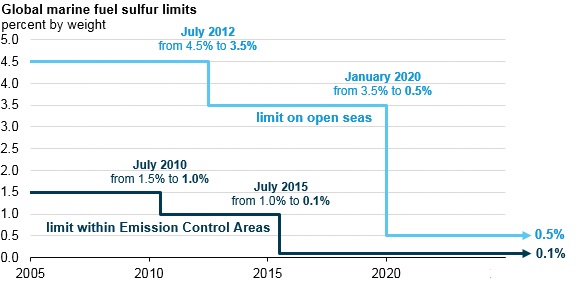

In order to markedly reduce the amount of sulfur oxides (SO

x) emanating from shipping, which has a major worldwide impact on health and the environment, particularly for those living close to ports and coasts, IMO has set a global limit for sulfur in fuel oil used onboard ships of 0.5%. This significant and far-reaching decision was announced by IMO’s Marine Environment Protection Committee (MEPC 70) in October 2016, when it was decided that the 0.5% sulfur limit should go into effect Jan. 1, 2020 (

see Figure 1).

Figure 1. IMO's Marine Environment Protection Committee (MEPC), meeting for its 74th session (May 13-17), approved numerous rules to promote the application of the Jan. 1, 2020 sulfur limit. (Figure courtesy of the International Maritime Organization (IMO), www.IMO.org.)

Figure 1. IMO's Marine Environment Protection Committee (MEPC), meeting for its 74th session (May 13-17), approved numerous rules to promote the application of the Jan. 1, 2020 sulfur limit. (Figure courtesy of the International Maritime Organization (IMO), www.IMO.org.)

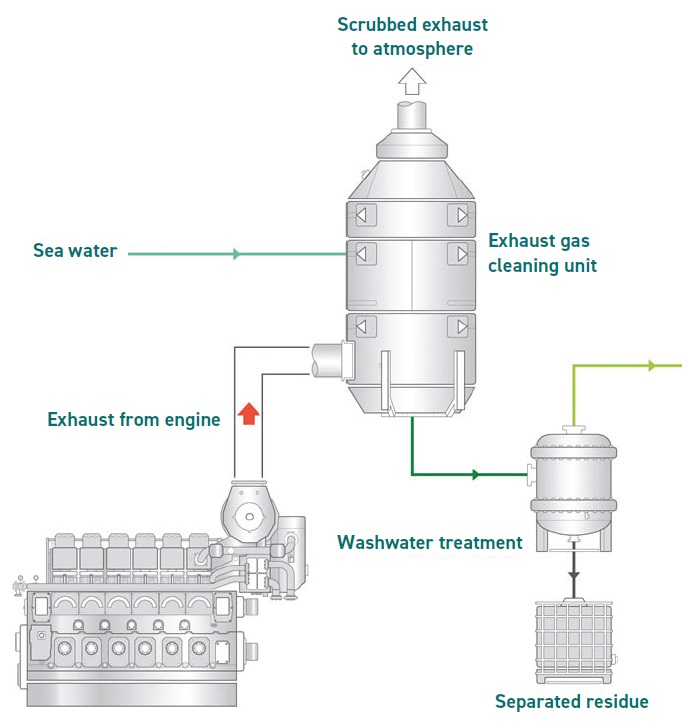

In many cases, to reduce emissions from ships, much lower sulfur fuels will be used, but this is not a specific requirement of the regulation. The new emissions standard may be met by using approved equivalent methods, such as exhaust gas cleaning systems (scrubbers) (

see Figure 2), which clean the emissions before they are released into the atmosphere.

Figure 2. Basic components of an exhaust gas cleaning system (scrubber). (Figure courtesy of the Exhaust Gas Cleaning Systems Association.)

Figure 2. Basic components of an exhaust gas cleaning system (scrubber). (Figure courtesy of the Exhaust Gas Cleaning Systems Association.)

Given the harsh internal environment of the upper (combustion) area of the ship’s engine, specialized lubricants are required for the lubrication of the cylinder liners. These lubricants need to combat the products of combustion including acids which, if not effectively neutralized, can have a negative effect on the cylinder liner surface leading to poor engine performance, engine breakdowns and costly repairs.

Cylinder lubricants range in base number (BN) from 20 to 100, with 70 BN and 100 BN being the most common grades able to handle fuel ranging from 1.0% sulfur to 4.5% sulfur.

Current cylinder lubricants may not be suitable for use with lower sulfur fuels. Operating for long periods on these low-sulfur fuels will almost certainly result in adverse cylinder liner and piston conditions, necessitating the development and formulation of more compatible cylinder lubricants. In addition to handling lower sulfur fuels, new cylinder oils will need to be fully compatible with other cylinder oils.

Peter Curtis, chief technical and commercial officer, Seaspan Corp., explains, “Vessels using low-sulfur-compliant fuel will require switching to low-BN cylinder oils. The cylinder oils are chosen in such a way that their alkalinity neutralizes any corrosive acidic sulfur in the fuel. However, excess of alkaline content in the cylinder lubricant can be detrimental to the engines and lead to polished or scuffed liner wear. Cylinder oil matching the fuel’s sulfur content will be required. We understand from engine makers as well as oil suppliers that some new formulations are presently being tested, and we may possibly see new products in the market in the future. Until then, low-BN cylinder oil is recommended for use with low-sulfur fuel.”

When asked about his biggest concerns regarding the probable changes to the formulation of cylinder lubricants, Rod Holmes, technical manager for a ship-management company, replies, “I think it will be difficult to get the correct BN. It will probably be between 10 and 40. It will either be too high or too low, and only experience with the products will determine what is correct. Slow steaming also makes things a bit more complex since the engines have more complete combustion at higher loads—as they were designed to run on the higher load.”

Effects of SOx from cargo ships

Heavy fuel oil, which is the residue from distilled crude oil, is the main type of bunker oil for ships. Crude contains sulfur, which is injurious to human health. It has been linked to lung disease and a host of respiratory symptoms. It is suspected of damaging fertility and may cause organ damage after prolonged exposure. Left stagnant in storage tanks, lethal hydrogen sulfide gas can form.

According to a 2018 study, prolonged exposure to shipping-generated particulate matter causes about 400,000 early deaths annually from heart disease and lung cancer (

1).

A 2016 Finnish study on the health impact of SO

x emissions from ships, submitted to IMO’s Marine Environment Protection Committee, concluded that if the limit for sulfur was not reduced by 2020, air pollution from ships would contribute to more than 570,000 deaths globally from 2020 to 2025 (

2).

In addition, shipping industry safety data sheets classify this fuel as hazardous and harmful to fish, toxic to crustaceans and shellfish and very toxic to aquatic plants. Because of all this, sulfur has been on IMO’s radar for a long time.

IMO

Headquartered in London, IMO was the result of an agreement at a UN conference in 1948. It officially came into existence in 1958, meeting for the first time a year later. Today, IMO has 174 member states and three associate members.

IMO serves as a regulatory framework for the shipping industry. It oversees all aspects of international shipping, including ship development, operations, personnel and disposal. It prevents ship owners and operators from dealing with financial issues by cutting corners that lead to compromises on safety, security and environmental health.

Limit regulations

The sulfur content of ground and air transportation fuels has been dropping for years because of increasingly tight regulations. For example, U.S. federal and state regulations have limited the amount of sulfur in most fuels for more than a decade (

see Figure 3).

Figure 3. History of global marine fuel sulfur limits: Percent by weight. (Figure courtesy of U.S. Energy Information Administration, based on International Maritime Organization (IMO).)

Figure 3. History of global marine fuel sulfur limits: Percent by weight. (Figure courtesy of U.S. Energy Information Administration, based on International Maritime Organization (IMO).)

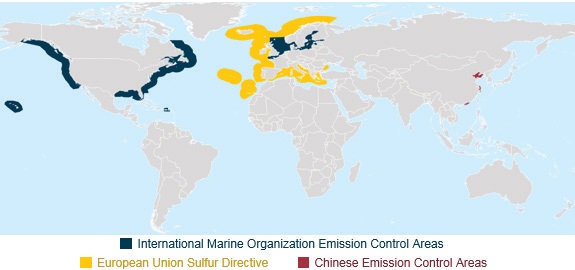

Open-sea fuel accounts for most of the 3.5-4 million barrels per day bought and sold in the international marine fuel market—this will, of course, be severely diminished once the new regulation goes into effect. To cover the open seas, IMO is reducing the maximum amount of sulfur content in marine fuels used outside territorial waters from 3.5% to 0.5% by 2020. These new IMO regulations are intended to reduce not only sulfur but nitrogen oxides and other pollutants from global ship exhaust as well (

see Figure 4).

Figure 4. IMO’s designated marine sulfur limitation areas. (Figure courtesy of U.S. Energy Information Administration, based on International Marine Organization, European Union and China’s Ministry of Transport.)

Compliance options

Figure 4. IMO’s designated marine sulfur limitation areas. (Figure courtesy of U.S. Energy Information Administration, based on International Marine Organization, European Union and China’s Ministry of Transport.)

Compliance options

Switching to a low-sulfur fuel is the simplest, most effective and least risky way to comply with the new standard, but it is not the only way. Ship operators actually have several options:

1. Switch to low-sulfur fuel

Fuel that is commonly used in shipping today is composed of the residue after higher-value gasoline and diesel have been extracted. Removing sulfur from these (literally bottom of the barrel) bunker fuels is one option (

see Bunker Fuel). Another option is to upgrade to cleaner versions of gasoline and diesel. Most ships are expected to comply by using the new blends of fuel oil, which will be produced to meet the 0.5% limit on sulfur. Current low-sulfur fuel is expensive and new fuels to meet the new regulation will be even more so.

Bunker fuel

Bunker fuel is the common term for any fuel that powers a ship’s engines. Typically it is the heavy, residual oil that remains after gasoline, diesel and other light hydrocarbons that are extracted from crude oil during the refining process. It is a brown to black liquid with a characteristic odor. Types of bunker fuel include A, B and C:

•

Bunker A. Gasoil (

3) range bunker fuel, typically referred to as marine diesel or marine gasoil.

•

Bunker B. Low-viscosity vac resid (

4) range bunker fuel. Typically cut with some lighter material VGO (vacuum gasoil) to decrease viscosity sufficiently to allow flow without heating.

•

Bunker C. This is the most common form of bunker fuel—when the term bunker fuel is used without qualification, it is in reference to this. It is usually mixed with up to 10% of a lighter fuel before it is used for shipping.

When compared with other vehicle fuels, bunker fuel is much dirtier but also much cheaper. It also is a persistent oil, capable of spreading large distances because it does not easily evaporate.

According to Holmes, most vessels under Grindrod Ship Management’s control (21 handy and supramax bulk carriers) use LSMGO (

5) in ports located in Europe, U.S., China, Hong Kong and more where required. “We have used this for a number of years on the generators and boilers and more recently on the main engines,” he says.

“Generally speaking, most of our customers have elected to comply through means of supplying our vessels with compliant, low-sulfur fuel,” Curtis says.

2. Switch to non-petroleum-based fuels

Ship operators also could switch to non-petroleum-based fuels. The big sticking point is that the current global bunkering infrastructure to support refueling is severely limited. Most of today’s liquid natural gas (LNG)-powered ships are coastal vessels limited to European waters where refueling is available. Other issues are the need for increased, dedicated storage space and a gap in supply chain logistics.

Another downside is the necessity of retrofitting ships to burn LNG. It is a highly technical, complex and expensive operation that requires modification of existing engines or the addition of gas tanks. Given all of this, while it is hard to make the case for LNG with existing ships, it may still make sense for new ships.

3. Install scrubbers

A debated option is to use scrubbers (

see Scrubbers) to remove SO

2 from ships’ exhaust. This would allow ships to continue using higher-sulfur fuels; these higher-sulfur fuels, however, may not be readily available in a few years.

© Can Stock Photo / SNR

Scrubbers

© Can Stock Photo / SNR

Scrubbers

There are several different types of marine exhaust gas cleaning systems or scrubbers that remove sulfur dioxide from the ship’s exhaust gases. Most have three basic components:

1.

A container where the exhaust stream from an engine can be thoroughly mixed with seawater and/or freshwater.

2.

Treatment machinery to remove pollutants from the wastewater when the scrubbing is done.

3.

Sludge-handling facilities—the sludge must be retained onboard for disposal ashore.

The system may be open loop with the water used for scrubbing taken from the sea and discharged back into the sea where it is naturally neutralized. Or the system may be closed loop where freshwater used for neutralization and scrubbing is treated with an alkaline chemical and then recirculated.

Hybrid systems can operate in either open or closed loop and, when in closed loop, with either freshwater or seawater. These scrubbers tend to be up high up in the ship for reasons of available space and access.

According to Peter Curtis, Seaspan Corp.’s chief technical and commercial officer, about 9% by count and 14% by capacity of Seaspan vessels have already been fitted with scrubbers.

Scrubber technology involves spraying alkaline water into the ship’s exhaust to remove SO

2 and other unwanted chemicals. The use of scrubbers will remove almost all harmful emissions from ships including up to 98% of SO

2 and up to 80% of particulate matter.

As with the previous two options for compliance, installing scrubbers is expensive—an initial investment ranging from $5 million to $10 million per ship. Installing scrubbers can be economically attractive, though, because of the significant savings on low-sulfur fuel over the long term.

A small percentage of ships already are using scrubbers. That number has not grown appreciably since the new regulation was announced.

Chris Kirton, managing director, Norstar Ship Management Pte Ltd., says, “We will meet the requirements through the use of low-sulfur fuel oils (LSFOs) and, where needed, low-sulfur diesel/gas oils. We have no intention to fit scrubbers to any of our vessels as apart from the fact that we operate smaller size chemical tanker vessels where fitting scrubbers would pose a technical challenge, we do not believe that fitting scrubbers is an ecologically sound decision. Further, we have no oversight on what the availability of IFO 380 (

6) will be going forward, and we certainly have no faith in what the experts are telling us the price of this fuel will be.”

Kirton continues, “From our point of view, there should not even be an option to fit a scrubber. The IMO should have mandated that everyone use LSFOs with an ambitious phase-out program to replace carbon-based fuels with alternatives. Fitting a scrubber is kicking the can down the road when what we need is real change of fuel policy.”

On the other hand, Curtis sees scrubbers as a viable option. “We have engaged with two customers to date, and by mutual agreement we have agreed to install scrubbers on 10 large vessels against an increased hire payment from those customers. The scrubber initiative is one where capture of the arbitrage in price between low- and high-sulfur fuels pays back the capital and operational investment in scrubbers in a reasonable period of time.”

He adds, “A consideration that we recognized had to be satisfied was these vessels would operate into the future on routes where high-sulfur fuels would remain available. Additionally Seaspan has engaged in careful analysis of fuel pricing into future years, a difficult task as 0.5% sulfur fuel pricing has been difficult to assess until recently. With fuel oil crack futures now being available, it is apparent that our fundamental assumptions have been supported, and the payback of scrubber investments is well supported.”

Holmes observed “quite a few” scrubbers being fitted in China recently. “Scrubbers are mainly for high-bunker-consuming vessels,” he explains. “The return on investment for smaller vessels will be minimal, plus you have the issue of having to maintain them. It also will mean that two generators will have to be run at sea requiring additional fuel to power the scrubber pumps. Disposing of scrubber wash water also will be an issue.”

4. Do nothing

The fourth compliance option is non-compliance. In some cases the option of ignoring IMO and continuing to burn non-compliant fuel oil without a scrubber may look advantageous. This is especially true because of the lack of clarity on IMO inspection and enforcement.

The U.S. is a strict enforcer of environmental regulations in its territorial waters, as are the European Union, Australia and New Zealand. But few expect other countries to develop a robust enforcement system before 2020. At distances of more than 200 nautical miles away from land, it will be the responsibility of the country under whose flag each vessel is registered to enforce the sulfur cap. The truth is, no concrete plan has yet emerged on how to enforce the sulfur limit in the high seas.

Already, the cost of bunker fuel represents 30%-50% of the total operating cost of a ship. And if the price differential between high-sulfur fuel oil and 0.5% sulfur fuel widens to as much as $400/metric ton, there will be a strong financial incentive to burn non-compliant fuel and risk consequences, especially if the fine is significantly less than the potential savings in fuel costs.

Lube and additives compatibility

The sulfur reduction process also decreases the natural lubricating properties of the fuel. Sulfur is not itself a lubricant, but in many metal alloys it can mix with nickel content to form a low melting point eutectic (

7) alloy that can boost lubricity.

Also, LSFO creates sulfuric acid, so if a lubricating oil with the right BN isn’t used, the alkaline produced in the cylinder won’t be neutralized. This could damage parts of the combustion chamber, including the liner. At some point, the alkaline deposits disrupt the cylinder oil film, which results in scuffing and ultimately engine seizure—thus, the importance of switching to low-BN lubricating oil when switching to LSFO.

New cylinder additives and lubricants that address fuel quality and engine health affected by very low-sulfur fuel oil (VLSFO) are entering the market.

Additives

•

Lubrizol is introducing additive packages to address the impact low-sulfur fuels could have on stability, combustibility and asphaltene precipitation.

•

Chevron Oronite’s OLOA 49835 is for blending BN 40 cylinder oils and designed for compliant fuel blends.

Lubricants

•

Shell Marine will have a BN 40 lubricant for two-stroke engines running on 0.5% sulfur fuel oil available before the IMO regulation goes into effect on Jan. 1. Shell Alexia 40 has been tested extensively on ships with engines running on compliant fuels. It is already available for use in Singapore and will be available in other primary supply ports before Jan. 1. Alexia 25 (BN 25) is designed for use with 0.1% sulfur fuels.

•

ExxonMobil’s BN 40 product is Mobilgard 540 for both 1% and 0.5% sulfur fuels. The company is developing a separate product for use with LNG.

•

Total Lubmarine, Singapore, has a BN 25 lubricant for use with .01% sulfur fuels.

“I don’t see any major issues, although there will be a period of testing once new lubricants are introduced to ensure that we are using the optimum formulation for our needs,” Kirton says. “We have been planning the change for some time and, as a company, believe that we have this covered with our lubricant supplier. Our lubricant supplier has been very active and has been providing good information and resources to help us.”

“As should be the case with all ship owners and operators, Seaspan is evolving solutions for the impacts of IMO 2020,” Curtis says. “Given that we time-charter our vessels to the main liner companies, who therefore procure the fuels, the preparations necessarily involve agreements between Seaspan and our customers.”

Curtis continues: “Generally speaking, Seaspan is proactive about meeting all regulatory and competitive needs, and we have been working on IMO 2020 for almost two years to date. We will be ready in terms of agreements with customers, logistical arrangements for cleaning tanks of IMO 2020 non-compliant fuels (i.e., greater than 0.5% sulfur), equipment modifications or upgrades, fuel storage and handling issues and, of course, procedures. Additionally, we have a number of vessels being prepared for scrubber installations within the next 12 months.”

Curtis concludes, “It is still not clear what property new low-sulfur fuels will have, especially hybrid fuels. This can have an impact of how these fuels will be treated and stored on board the vessels. Although our engines, boilers and ancillary machinery are designed to operate on low-sulfur fuel, the performance and operation will have to be watched carefully. Vessels with scrubber installation will have their own challenges in operation. The environmental impact is yet to be ascertained.”

REFERENCES

1.

From

Cleaner Fuels for Ships Provide Public Health Benefits with Climate Tradeoffs. Available

here.

2.

From IMO’s

Air Pollution and Energy Efficiency Study on Effects of the Entry into Force of the Global 0.5% Fuel Oil Sulfur Content limit on Human Health. Available

here.

3.

Gasoil is a broad term that can refer to a range of intermediates and finished petroleum products, generally in the diesel or VGO range of distillation profile.

4.

Vacuum residual is the heaviest of the distillation cuts—literally the bottom of the barrel.

5.

Low sulfur marine gas oil.

6.

Intermediate fuel oil with a maximum viscosity of 380 centistokes and less than 3.5% sulfur.

7.

Eutectic refers to a mixture of fixed proportion substances that melts and solidifies at a single temperature lower than the melting points of the individual substances or of any other mixture of the substances.