KEY CONCEPTS

•

World lithium production is dominated by a few key players and prone to price and supply instability.

•

The battery industry will continue to drive the demand for lithium for the foreseeable future.

•

Alternative grease thickeners are increasingly competing with lithium thickeners, but there are key differences with formulations and applications.

Compared with the lithium battery industry, grease manufacturing is a small market sector. However, lithium compounds play a key role in a majority of grease formulations, and these greases help keep bigger market sectors like automobiles and aerospace running smoothly.

How are grease manufacturers responding to a changing environment where lithium compound supplies and prices are increasingly affected by the booming demand for batteries?

Demand is expected to grow modestly in other industries that also use lithium compounds, including glass and ceramics, polymers, aluminum manufacturing, agrochemicals, pharmaceuticals, air treatment, construction, aerospace alloys and a few others. However, since the rise of the portable electronic device industry in the 1980s and 1990s and the current expansion in the market for electric vehicles, manufacturers of lithium-ion batteries have become the biggest consumers of world lithium supplies. Demand for lithium for rechargeable batteries is predicted to grow significantly until at least 2025 (

see Lithium by the Numbers).

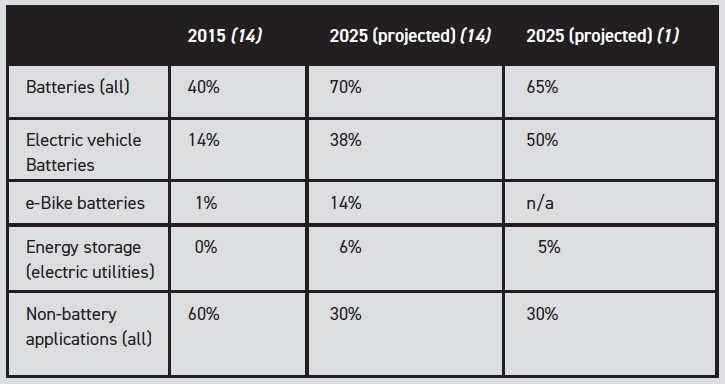

Lithium by the numbers

In 2017, the market for lithium greases was about 1.8 billion pounds—about 75% by volume of the 2.4-billion-pound lubricant grease market. As of August 2019, the battery industry claimed more than half of the world’s lithium production, with slightly less than one quarter going to the ceramics and glass industry, and about 6% going to lubricating greases (

13).

Lithium demand, by application (percentage of world demand)

“It’s a big issue. It’s on everybody’s radar screen,” says Andy Waynick, research fellow at NCH Corp., a manufacturer of industrial chemicals in Irving, Texas. Even though the balance is shifting away from lithium soap thickeners and toward lithium complex greases, the total sales of both types of greases has been holding steady at about 75% of the market by volume for the past 40 years. However, Waynick says, “I believe we’re starting to finally see possibly a decline in the total amount of lithium-based greases worldwide. And if that is the case, certainly, it’s due to the price of lithium, because there really isn’t any other driver that would make that happen.”

The force of this impact depends largely on the nature of a manufacturer’s operations and its sourcing strategies, however. Commodity-scale operations are the most affected by changes in lithium prices. Big-batch producers of widely used lithium greases, which often compete on the basis of price and rely on their large production volumes to maintain profitability, are the most sensitive to lithium price fluctuations. The largest producers can blunt the impact somewhat by negotiating prices and entering into long-term agreements with their suppliers. They also can help contain costs by streamlining their operations with dedicated equipment and proven processes.

Companies that produce small batches of a diversified portfolio of grease formulations can be more agile in adapting to market conditions. NCH makes a diversified portfolio of grease formulations, Waynick says, so lithium price increases have not affected the company as strongly as companies more heavily invested in lithium-based greases.

Manufacturers of specialty and high-performance greases can be even better positioned to weather price changes because their products are sold on the basis of performance rather than price. These greases perform well at extreme temperatures, in corrosive environments, in medical and food applications and many other tasks for which ordinary greases aren’t suitable. STLE-member Chad Chichester, an application engineer with DuPont in Midland, Mich., works for DuPont’s MolyKote Specialty Lubricant business, which provides just such high-performance lubricants.

Chichester notes that the increase in lithium prices has not had much of an impact on their grease manufacturing operations and overall these increases have been manageable in size. He adds that since lithium hydroxide-based thickener makes up only about 10% of a typical grease formulation, a price increase that isn’t too extreme is manageable. However, industrywide, manufacturers are paying more attention to other technologies (calcium sulfonate thickeners, for example) that used to be price prohibitive but now are more competitive with lithium. “We’re all trying to forecast whether lithium supply is really going to be a problem,” Chichester says.

Supply and demand

Earth’s crust contains approximately 20 parts per million of lithium, and the oceans contain 0.17 parts per million. Igneous rocks—chiefly the aluminosilicate mineral spodumene but also the aluminosilicate petalite and a lithium mica called lepidolite—are the main sources of lithium ore. Concentrates derived from these ores can be processed to produce either lithium carbonate, which is used in a variety of industry sectors (including some battery applications), or lithium hydroxide, which is the preferred compound for producing lithium grease thickeners—and high-nickel battery cathodes (

1).

Subsurface brines supply most of the remainder of the lithium carbonate on the market. Brines can be processed into chemical products on site, which significantly cuts production costs, and the resulting high-value products makes them especially profitable. In 2016 two-thirds of the world’s commercial lithium products came from brine sources, but brine and mineral sources contributed almost equally by the beginning of 2019 (

2). Although the demand for lithium carbonate is expected to remain strong, the battery industry’s demand for lithium hydroxide is expected to exceed that for lithium carbonate sometime within the next decade or so, which favors the continued expansion of solid mineral sources (

3).

Currently Australia is the world’s largest lithium ore producer (51 metric kilotons of lithium content in 2018), followed by Chile (16 kilotons). The next six countries combined produced almost 18 kilotons in 2018 (

4). Although Australia is a major producer, much of this ore is converted to commercial products in China. China has emerged as a significant supplier of commercial lithium compounds, and it is aggressively expanding production capacity, including building lithium hydroxide conversion facilities on site at the Australian mines it operates. Six producers currently account for about 85% of the global supply of refined lithium compounds: Albemarle, Jiangxi Ganfeng Lithium, Livent, Orocobre, SQM and Tianqi (

5).

When only a few countries or companies dominate a market sector, natural disasters or political disruptions in one major supplier country can have repercussions around the world. For example, Chile holds more than half of the world’s known lithium reserves, including a major reserve at the Atacama Salt Flats. Chile has a reputation as a stable country, but in October 2019 protesters from indigenous communities blocked access to lithium operations at the Atacama Salt Flats as a part of a larger nationwide protest over economic inequality (

6).

Demand and supply also can get out of balance—a shortage in 2016 caused lithium prices in China to more than triple (

2). However, today’s prices are about half what they were at the end of 2017, in part due to increased production and delayed adoption of high-nickel battery cathodes for automotive applications. Some sources predict an impending oversupply of lithium carbonate conversion capacity—and a possible shortage of battery-grade lithium hydroxide (

1, 7).

Chichester notes that a variety of unknowns make it hard to predict how lithium prices will evolve. Will electric vehicles (EVs) become as popular as many forecasts predict? How will vehicle emission regulations factor into EV demand? What effect will trade policy between China and the U.S. have on the EV supply chain? Will backup batteries for electrical utilities increase their storage capacity from several hours’ worth of energy to a weekly or monthly scale? Will battery recycling become popular—or well-subsidized—enough to affect the demand for lithium ore?

Increasing demand will drive more intensive searches for new deposits of lithium minerals. Just as the discovery of large petroleum reserves in the North Sea and the Middle East changed the global petroleum market, new sources of lithium could change the economic picture, Chichester says. However, supplies are not infinite. By one estimate, providing one electric vehicle like the Nissan Leaf for every two people in the world (a North American standard of living) would require vehicle batteries alone to use about 82% of the world’s lithium reserves (all the lithium that is currently economical to produce) or about 32% of the world’s total identified lithium resources (

8).

How can lithium grease manufacturers maintain their businesses in the face of all these competing factors?

Chile holds more than half of the world’s known lithium reserves, including a major reserve at the Atacama Salt Flats.

Lithium grease

Chile holds more than half of the world’s known lithium reserves, including a major reserve at the Atacama Salt Flats.

Lithium grease

Lithium thickeners are attractive in part because they work well with a wide variety of base fluids and perform well over a wide range of temperatures and operating conditions. Lithium greases also have advantages outside of their technical aspects, says STLE-member Wayne Mackwood, global application technology head of detergents and grease for LANXESS Canada Co.; Lubricant Additives Business Unit. Lithium greases are well established in the market. Industry has long-standing supply chains, production facilities and processes for making lithium greases in large quantities. Customers are familiar with how these greases perform, and they may be reluctant to invest the time and expense of selecting and testing a different product in their well-established operations, he says.

Greases made with simple lithium soap thickeners first appeared in the 1940s, starting with Clarence Earle’s 1942 patent (U.S. 2,274,675). Users found that these greases resisted water better than greases made with sodium soaps, and they performed better at high temperatures than calcium soap greases did. Lithium soap greases resist shearing, and they exhibit good pumpability properties, although they require the addition of antioxidants. This combination of advantages outweighed the extra manufacturing expense compared with calcium and sodium thickeners, and lithium soap greases (notably lithium 12-hydroxystearate formulations) quickly claimed a large share of the market (

9).

Lester McClennan patented the first lithium complex grease in 1947 (U.S. 2,417,428), but lithium complex greases did not become popular commercially until the early 1980s (

9). For the past 20-30 years, manufacturers have been shifting away from thickeners based on simple lithium soaps to lithium complex thickeners because of the latter’s better performance at high temperatures, Waynick says.

Lithium complex formulations require more lithium hydroxide to fully react with the combination of 12-hydroxystearic acid and a dicarboxylic acid than is required for the single 12-hydroxystearic acid used for lithium soap greases, Waynick says. In addition, lithium complex grease formulations require more thickener to produce the same consistency. A lithium-12-hydroxystearate soap grease can use about 5%-8% thickener to produce an NLGI #2 consistency. Lithium complex thickener systems, on the other hand, can require more than 10% thickener. However, over the past several decades, customers have become more willing to pay the extra cost in exchange for the high-temperature performance benefit, he adds.

One way to counteract higher lithium prices is to formulate thickeners that use less lithium. There are several ways to improve the thickener yield, especially for lithium complex greases, Waynick says. Properly formulated greases with a higher thickener yield can achieve the necessary level of performance using less thickener than for a lower-yield grease, he explains. Waynick recently patented an over-based sulfonate-modified lithium carboxylate grease (U.S. 10,392,577, Aug. 27, 2019) that incorporates 0.01%-10% over-based calcium or magnesium sulfonate in addition to 1%-5% lithium hydroxide. This is another way to reduce the amount of lithium needed to react with the acids in the formulation.

Companies that make large quantities of lithium greases can reduce costs by streamlining production. One way is to purchase a stable suspension of lithium hydroxide in base oil. This product undergoes a very clean, fast, efficient reaction in a grease kettle to form a lithium grease (simple or complex) with an improved thickener yield. Because the reaction is fast and requires only one heating and cooling cycle, this reduces the time in the process kettle (which affects the overall production time more than the finishing kettle), lowering manufacturing costs overall. This approach is probably not cost-effective for companies making small amounts of such grease, Waynick adds. However, Mackwood notes that using this type of stable suspension enables the use of specialty fluids such as esters, which could saponify in the presence of lithium hydroxide and the water formed in the thickener reaction.

Commodity producers of lithium greases can reduce costs by making their manufacturing processes more efficient and by reducing the amount of reject material, Chichester says. Using dedicated contactors or kettles to make large batches of lithium greases allows these large-scale producers to optimize their operations for a particular product, which can help with process stability and cost reduction. Having a stable, repeatable process also reduces the costs of quality assurance, since if all the parameters of the process are within specifications, the product will be within specifications as well. If demand for a particular product goes down, however, the company may face a problem with asset utilization. Specialty grease makers make their product in smaller batches, and they may make a greater variety of products, “So changeovers are just something you do,” he adds.

Another way to cut down on lithium usage is to increase the service life of the grease. Even though reformulating a grease could increase its initial purchase price, its service life might improve by as much as 50%, leading to savings over the long term, Waynick says. Typically, grease manufacturers have targeted their formulations toward the minimum requirements set out by NLGI specifications or their customers’ specifications in order to keep their costs competitive, he adds. Now, with lithium costs increasing, the manufacturer might find it worthwhile to offer a higher-performing product that generates savings over the life of the product because of reductions in the amount used.

Equipment design can reduce grease usage in general. For example, automotive wheel bearings used to need periodic lube jobs as a part of routine maintenance. Now, however, the grease in these bearings lasts for the life of the car. NLGI is revisiting their specifications for chassis lubricants because of the sealed-for-life chassis lubrication in newer vehicles, Waynick says.

Formulating alternatives

Substituting other thickeners for lithium-based thickeners requires formulators to be aware of several factors. One of the most important is compatibility between the thickener and the base fluid. For example, trying to thicken a silicone base fluid with an over-based calcium sulfonate can cause problems if the thickener is so alkaline that it begins to cleave the chemical bonds in the silicone polymer, Chichester explains.

Some greases already use other thickeners as a matter of course. For example, lithium thickeners do not perform well for high-temperature applications, so high-temperature greases made from perfluoropolyether (PFPE) base oils typically use other types of thickeners. Also, some calcium sulfonate complex (CSC) greases are approved for incidental contact use in the food industry, where lithium greases are not approved (

10).

Waynick notes that polyurea thickeners, which have been around since the mid-to-late 1960s, remain the gold standard for high-speed, high-temperature electric motor and wheel bearings, including fill-for-life applications. The shear stability of these greases has improved, making them a viable alternative to lithium greases, he says. Aluminum complex greases have high dropping points and are good for some applications, he continues. These greases have good shear stability at low temperatures, but their shear stability suffers at high temperatures, which limits the number of applications for which they are suitable.

Simple calcium sulfonate greases, which perform well in wet or humid environments, have been the greases of choice for protecting post-tensioning cables in tall buildings, says Waynick. These cables, which inevitably see some exposure to humid air, must remain rust-free for the life of the building. Even though CSC greases are ideal for submerged cables (the grease remains on the cables rather than floating to the surface), and their excellent corrosion resistance properties helps drive their extensive use in submerged environments, they are not currently used in formulations approved under the U.S. EPA’s Vessel General Permit (VGP) requirements. Here, lithium greases predominate (

11).

Non-lithium grease thickeners can perform as well as or better than lithium-based thickeners for many applications under the right conditions, says Mackwood, who has focused much of his work on CSC grease thickeners. CSC greases provide an attractive alternative should the lithium market experience a major disruption, and the raw material supplies and costs appear more stable, he explains.

However, non-lithium greases are not exact matches with respect to how they are formulated and where they achieve their optimum performance, so it’s important to compare the specific strengths and limitations of each type of grease. Lithium thickeners, with their fibrous structure, have a butter-like texture, Mackwood explains, and they form greases that shear differently from CSC greases, which have a particle-like structure. This can lead to differences in mechanical stability.

One advantage to lithium thickeners is that less of these thickeners is required to produce the required amount of thickening, typically about 8% in an NLGI Grade 2 simple lithium grease, Mackwood says. For very low-temperature applications (in the aerospace industry, for example), the low amount of thickener reduces its effect on the torque and flow properties of the grease. By comparison, a CSC grease with a similar NLGI grade requires some 20%-30% thickener. However, CSC greases inherently provide corrosion resistance, antiwear properties and load carrying (EP) capabilities, which reduces or eliminates the need for additives that provide these properties. This eliminates the need to handle these additives and somewhat simplifies the formulation and manufacturing process.

CSC greases perform similarly to lithium greases under moderate conditions (low loads, moderate temperatures, dry conditions), but at high temperatures, CSC outperforms lithium with respect to dropping point, high-temperature shear and viscosity. Lithium greases typically have dropping points around 200 C, explains Mackwood, while CSC grease dropping points are well above 300 C—although dropping point isn’t always the best measure of the upper limit on performance, he adds.

Newer CSC grease formulations are a viable alternative for many applications, when they are used correctly, Waynick says. Originally, CSC greases did not perform well at low temperatures, but they now can be on a par with lithium complex greases. Newer formulations also provide a better thickener yield, he explains. In the 1980s, CSC greases required 40% or more of the over-based calcium sulfonate, but this amount has continually dropped and can now be below 20%, with an associated improvement in low-temperature performance.

Switching production lines

Most likely the largest grease producers all have CSC greases in their portfolio, Mackwood says. Producers with the proper expertise should be able to make these greases with their existing equipment, but yields, pumpability profiles and other performance properties might differ.

Although CSC greases can be made in the same type of reactor as lithium greases, with the proper adaptations, a more ideal way is to use a reactor properly suited for CSC greases. Mackwood explains that commonly used lithium soap thickeners are made from a simple reaction between lithium hydroxide and 12-hydroxy stearic acid, or lithium hydroxide is complexed with other acids to form lithium complex greases. Lithium hydroxide, derived from a mineral source, is truly a raw material, he says. The soap matrix for these greases is a fibrous network that holds the base oil. In contrast, over-based calcium sulfonate feedstocks, used to make CSC greases, are highly processed materials (

12). LANXESS makes its own calcium sulfonate, and the company, then called Witco, developed the over-based complex version of the grease in the 1980s, from those over-based sulfonates (

see Making CSC Thickeners).

Making CSC thickeners

Over-based calcium sulfonate formation involves a reaction between sulfonic acid, alcohol, an excess of calcium hydroxide and carbon dioxide, says Mackwood. The reaction between the calcium hydroxide and the carbon dioxide forms calcium carbonate, which is held within inverse sulfonate soap micelles.

Applying heat to liquid over-based calcium sulfonate in the presence of polar solvents transforms the calcium carbonate within the micelle from an amorphous solid into crystalline calcite, which changes the rheology of the sulfonate and contributes to the thickening effect. Co-thickening this grease with 12-hydroxy stearic acid reduces the amount of sulfonate needed by about one-half. The result is a mixed soap, with several components that contribute to the thickening effect, and greases made this way have a particle-like structure.

There are numerous methods for manufacturing CSC greases. Some processes use various alcohols, others simply water, or water and pressure. Differences in the process conditions, the source and structure of the sulfonate and the promoters and reactants used can lead to significant differences in final product properties and performance, he says.

The feasibility of switching production lines from lithium-based greases to other types of greases depends on the formulations, Waynick says. For example, making polyurea greases requires the use of toxic diisocyanates, as well as various organic amines that can be skin irritants. Pressure reaction kettles may be required to get a complete reaction with no harmful residues in the final product. Some manufacturers of lithium soap greases use pressure kettles, which could be converted over to polyurea grease making. On the other hand, he adds, CSC and aluminum complex greases can be made in open-kettle operations. It may not be possible to switch contactors or continuous processing operations over to non-lithium thickeners, although some preliminary research has been done on making CSC greases in a contactor, he says.

Other specialty greases with very specific demands, like PFP, PTFE or silicone greases, require dedicated assets, Chichester says. MolyKote makes a variety of specialty greases, but even then, a large percentage of their products are lithium-based, he adds. The assets they use to develop and manufacture these greases are streamlined for making lithium-thickened products, so even though a kettle or contactor may be used to make several products, these products won’t necessarily have different thickening systems.

No silver bullet

“I don’t see there being any one answer to the lithium problem,” says Waynick. He predicts that manufacturers will take a multi-pronged approach to address lithium price increases. Increasing thickener yield to reduce the amount of lithium in the formulation without decreasing performance is one approach. Increasing product performance to extend service life and reduce overall grease usage is another. Still other approaches include alternative thickeners like new-generation calcium sulfonate complexes, polyureas and aluminum complexes.

Price negotiations and long-term sourcing agreements with lithium compound suppliers also can be effective toward containing costs. The lithium price situation has created a new dynamic, Waynick says before adding, “I don’t think you’re going to see lithium-based greases go away. I think they’re here for the long haul. But in another 10 or 15 years, you may see it’s no longer 75% of the market.”

REFERENCES

1.

Lu, S. and Frith, J. (Oct. 28, 2019), “Will the real lithium demand please stand up? Challenging the 1Mt-by-2025 orthodoxy,”

Bloomberg NEF. Available

here.

2.

Facada, M. (Jan. 25, 2019), “Lithium market turns focus to spodumene price trends,”

Fastmarkets. Available

here.

3.

Pistilli, M. (July 22, 2019), “Lithium hydroxide and lithium carbonate processing capabilities key to higher margins for lithium producers,”

Investing News. Available

here.

4.

U.S. Geological Survey National Minerals Information Center, Mineral Commodity Summary: Lithium, 2019. Available

here.

5.

Livent Corporation, U.S. Securities and Exchange Commission Form S-1 Registration Statement, Aug. 27, 2018. Available

here.

6.

Sherwood, D. (Oct. 25, 2019), “Chile protesters block access to lithium operations: local leader,”

Reuters. Available

here.

7.

Lithium’s price paradox, Benchmark Minerals Intelligence, July 30, 2019. Available

here.

8.

Eason, E. (Nov. 30, 2010), “World lithium supply,

Stanford University. Available

here.

9.

Turner, D. (January 2011), “Grease selection: Lithium vs. lithium complex,

Machinery Lubrication. Available

here.

10.

McGuire, N. (2019), “Incidental lubricants for the food industry,” TLT,

75 (12), pp. 18-24. Available

here.

11.

Vessels-VGP, National Pollutant Discharge Elimination System, U.S. Environmental Protection Agency. Available

here.

12.

Sniderman, D. (2016), “Calcium sulfonate complex greases,” TLT,

72 (10), pp. 28-40. Available

here.

13.

Barrera, P. (Aug. 12, 2019), “Top Lithium Production by Country,”

Investing News. Available

here.

14.

Leni, B. (Jan. 30, 2017), “The lithium supply and demand story,”

Mining dot Com. Available

here.

From TLT Archives

1.

Sniderman, D. (2016), “Calcium sulfonate complex greases,” TLT,

72 (10). Available

here.

2.

Van Rensselar, J. (2017), “Grease chemistry: Thickener structure,” TLT,

73 (12). Available

here.

3.

McGuire, N. (2018), “Lubricating grease designed for rolling element bearings,” TLT,

74 (3). Available

here.

4.

Sniderman, D. (2018), “Aesthetics in lubricating greases,” TLT,

74 (5). Available

here.

Nancy McGuire is a freelance writer based in Silver Spring, Md. You can contact her at nmcguire@wordchemist.com.