Shifting demand impacts global base stocks market

Anuj Kumar | TLT Market Trends October 2017

Key factors include economic uncertainty, rapid technological advancement and the reduced need for Group I products.

© Can Stock Photo / SSilver

KEY CONCEPTS

•

The global finished lubricant demand has grown by a small margin over a four-year period.

•

The global lubricant base stock market is in the midst of structural changes.

•

Two major factors affect the future demand outlook for finished lubricants: overall economic outlook and the growing use of high-quality lubricants.

Note: Mexico is included in South America in this analysis, since the finished lubricant quality levels in Mexico aligns more with South America than its North America counterparts.

THIS ARTICLE DISCUSSES THE MAJOR TRENDS impacting the global lubricant base stocks market and provides a view on how this market is expected to evolve over the next 10 years. It also draws from Kline’s recently published report, Global Lubricant Basestocks: Market Analysis and Opportunities.

MACROECONOMIC ENVIRONMENT

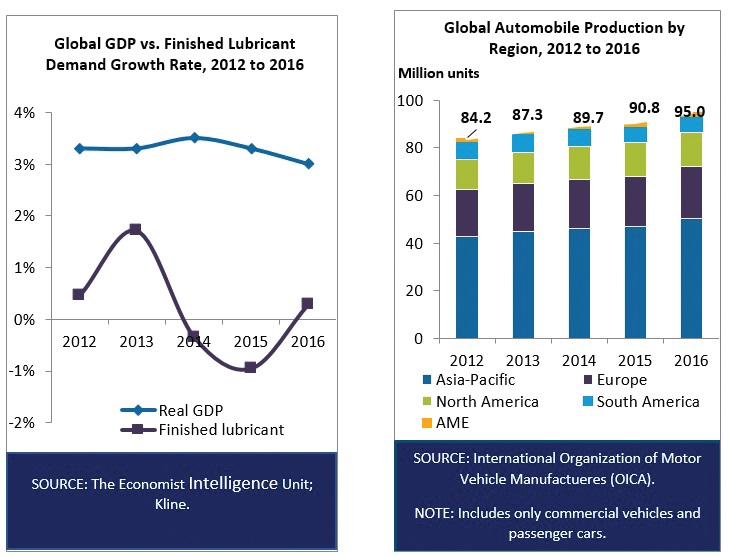

The global gross domestic product (GDP) growth has been a good indicator of growth in finished lubricant demand over the mid to long term. While the average global GDP growth rate over the 2012-2016 period has ranged between 3.0% and 3.5%, the global finished lubricant demand has grown at a CAGR of 0.2% over the same period.

Demand growth rates have been different for various regions. North America and Europe have mostly remained flat to negative. The high-growth rates in Asia-Pacific appear to have diminished lately, primarily due to the Chinese economy’s slowing down. South America also has lost steam recently, along with Brazil, the largest economy in the region. The Africa and Middle East region has maintained positive growth rates, but its performance has been plagued with political issues faced by some countries (

see Figure 1).

Figure 1. Demand growth rates have been different for various regions throughout the world.

Figure 1. Demand growth rates have been different for various regions throughout the world.

The global automobile industry, a key determinant of finished lubricant demand, registered an increasing growth rate in 2016, which otherwise remained on a downward trajectory since 2012. Asia-Pacific has emerged as the world’s hub for the automobile production driven mainly by markets like China, Japan, South Korea, India and Thailand.

Kline estimates global finished lubricant demand in 2016 at about 39.0 million tonnes, marking a slight growth over 2015. Asia-Pacific is the largest region in terms of demand, followed by a distant North America and Europe. South America and Africa and the Middle East are smaller regions in terms of finished lubricant demand.

SUPPLY AND DEMAND

The global lubricant base stock market is in the midst of structural changes. These changes, triggered over a decade back and earlier restricted to select markets, are now rapidly altering the landscape of the lubricant base stock market comprehensively. An uncertain global economic outlook, rapid technological advancement, brisk pace of setting up new base stock capacity and emerging frontiers of demand—while the traditional ones take a backseat—are all changing the composition of the market.

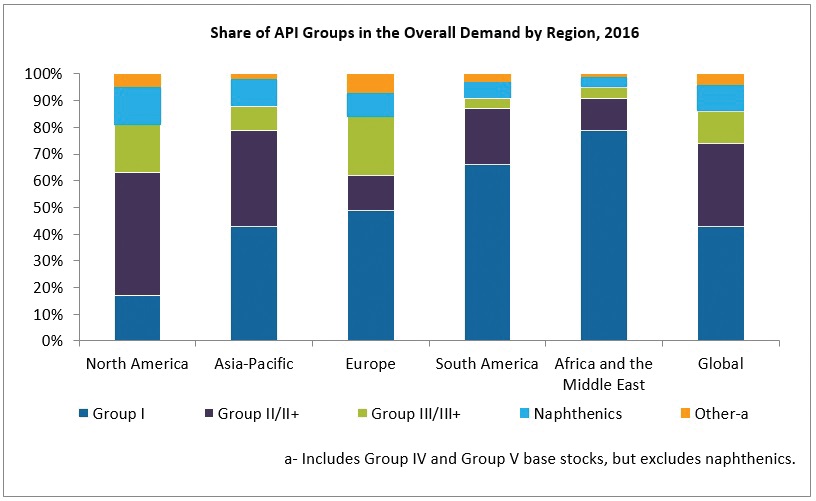

Kline estimates that the total demand for lubricant base stocks in 2016 is around 35.5 million tonnes (

see Figure 2). Globally, Group I is still the majorly consumed base stock, but its demand is declining due to the tightening of emission norms and fuel efficiency standards worldwide. These base stocks have higher sulfur content, which makes it undesirable from an emission norms standpoint. Moreover, Group I base stocks have lower thermal and oxidative stability, which makes them unsuitable to withstand the severe operating conditions in modern day automotive engines. Thus, there has been a growing demand for better performance base stocks, such as Group II, III and synthetic base stocks.

Figure 2. Kline estimates that the total demand for lubricant base stocks in 2016 is around 35.5 million tonnes.

Figure 2. Kline estimates that the total demand for lubricant base stocks in 2016 is around 35.5 million tonnes.

Group II has emerged as the mainstream base stock alternative to Group I, accounting for close to a third of the global demand. Not only does Group II find application in automotive engine oils, it is displacing Group I even from non-core applications, such as hydraulic fluids, as blenders optimize their storage costs and space stocking minimum grades required for most lubricants. Group III base stocks, which are primarily consumed in modern day passenger car engine oils, account for about 12% of the global market. Naphthenics have carved their own market space, accounting for 9%-10% of the global base stock demand. The balance is accounted by polyalphaolefins (PAO), which are classified as Group IV base stocks and other Group V base stocks.

On the other hand, the lubricant base stock supply in 2016 is estimated at around 39.1 million tonnes. With a demand of 34.2 million tonnes of base stocks (excluding PAO and other Group V synthetic base stocks), there appears to be a surplus of around 5 million tonnes. However, this surplus is consumed in several non-lubricant applications (which are not covered under Kline’s definition of finished lubricant), such as fuel blending, drilling fluids, shock absorber fluids and a host of other applications that have been developed locally and regionally to place the surplus product.

On a global basis, Group I is still the most widely produced base stock, but it is quickly giving up its place to Group II, which has witnessed rapid capacity expansion over the last 10 years. This is followed by Group III and naphthenic base stocks.

Depending on the availability of these base stocks in different regions and preference among blenders, different base stock gained prominence in different regions.

•

Europe. Historically, Europe has favored Group I—with Group III as a correction fluid—due to its abundant supply in the region. However, with changing performance requirements, the use of Group I in top-tier automotive formulations exited. Currently Group III and Group IV base stocks are used to formulate top-tier automotive lubricants while Group I applications are restricted to industrial and mid- to low-tier automotive products. Group II has a relatively small but growing market in Europe. The declining demand for Group I has resulted in several Group I plant closures in Europe. The existing Group I surplus is exported to Africa and Asia-Pacific.

•

North America. The region has an affinity toward the use of Group II as it became the most widely available base stock in the market and can address a wide range of formulations by providing better thermal/oxidative stability and less sulfur content than Group I. For blending synthetic lubricants, blenders consume Group III and other synthetic base stocks. Due to the oversupply of Group II base stocks in North America, it has found its way into non-core applications. Naphthenic base stocks are consumed in applications like greases, metalworking fluids, process oils, transformer oils, etc., and the surplus is exported to South America and a few Asian countries. In the absence of any Group III capacity, its deficit is met through imports from Asia-Pacific and the Middle East.

•

Asia-Pacific. The region has followed a Group I-led formulation approach, which is gradually being substituted by Group II, especially in automotive applications. Group III base stocks find application in synthetic lubricants, but due to its surplus in the region, it found its way to non-core applications such as white oils and transformer oils. The region has a surplus for Group II base stocks, which is directed toward Group I substitution.

•

The other two regions—South America and Africa and the Middle East. These regions still consume Group I predominantly with a small but growing role for Group II base stocks. South America’s proximity to the U.S. helps it gain easy access to Group II in the region. The Middle East has a large production of Group III, but in the absence of any technical demand, this is mostly exported to North America, Europe and Asia-Pacific. South America meets its deficit for Group I and II base stocks from North America. Due to a strong demand for obsolete lubricant grades, Africa requires Group I base stocks, especially heavier grades, which are mostly imported from Europe besides small regional production.

BASE STOCK OUTLOOK

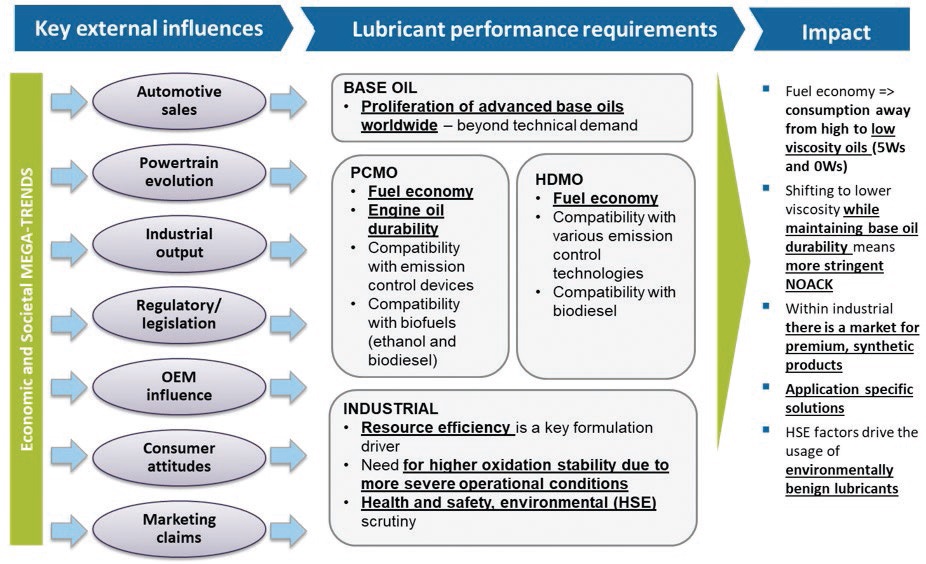

The base stock demand outlook is shaped by a host of factors, including growing stringent performance requirements, growing supply of high-performance base stocks and a regulatory environment, among others.

In December 2016, new heavy-duty motor oil (HDMO) categories were released—API CK-4 and FA-4. While CK-4 is backwardly compatible, FA-4 is not. FA-4 provides provisioning for fuel efficiency, a factor which so far was not a major concern for the HDMO product category. This creates a role for light viscosity oils in the HDMO segment, which implies a greater demand for lighter oils, such as Group II/III, is expected.

On the passenger car motor oil (PCMO) side, the ever tightening of emission and fuel efficiency norms is making it mandatory to use lubricants blended with high-performance base stocks. This trend is gradually extending to markets like China, India and other growing economies, which provide greater growth opportunities for these high-performance base stocks, such as Group II, III and IV.

On the industrial side, Group I (and naphthenics in select instances) is still the preferred choice for a wide range of lubricants, especially heavier grades. Certain applications require high solvency, which drives the use of Group I as they offer good additive solubility. Nonetheless, Group II is making inroads with industrial products, such as hydraulic fluids and gear oils. However, as equipment size reduces and performance output of equipment grows, there is tremendous pressure on lubricants that mandate the use of synthetic base stocks.

THE GLOBAL MARKET

The future demand outlook for finished lubricants is affected by two major factors: overall economic outlook and the growing use of high-quality lubricants (

see Figure 3). The overall macroeconomic environment indicates no major upswing in growth rates, but the uncertain environment has several risks. The growing use of synthetic lubricants enables oil drain interval extensions, which will have a dampening effect on finished lubricant demand growth. Consequently, Kline forecasts a finished lubricant demand growth at a CAGR of 0.5%-1.0% during the next 10 years.

Figure 3. Factors impacting the base stocks market.

Figure 3. Factors impacting the base stocks market.

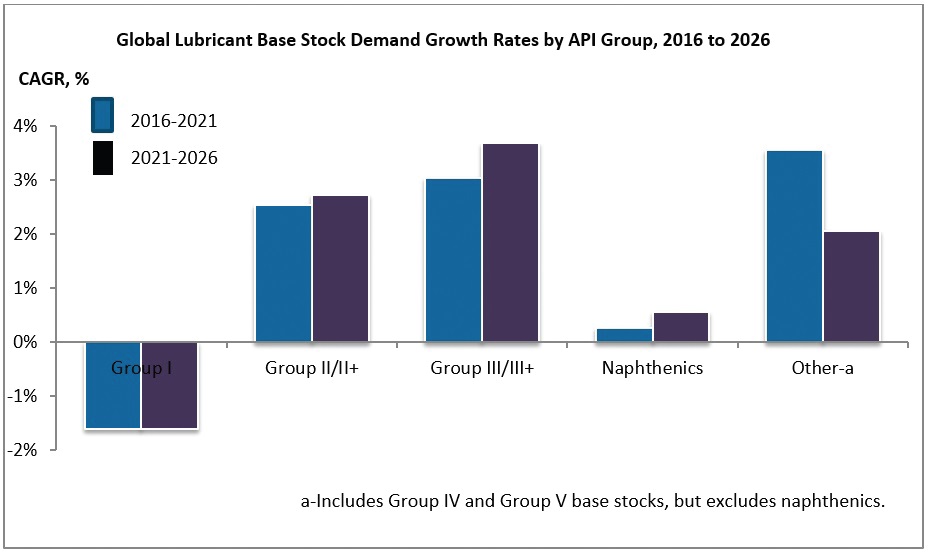

The demand for Group I will decline because of changing technical requirements and surplus Group II/III base stocks. Group II and III will enjoy good growth rates while naphthenic will grow marginally (

see Figure 4).

Figure 4. Demand growth rates for Group I will decline while Group II and III will enjoy good growth rates.

Figure 4. Demand growth rates for Group I will decline while Group II and III will enjoy good growth rates.

The supply dynamics also are changing simultaneously. Base stocks production is expanding to other markets that are challenging the position of existing suppliers. For instance, the Middle East is now a production hub for Group III/III+ base stocks. Earlier, northeast Asia accounted for the bulk of this production. Moreover, new Group III capacities are being planned in Europe—a leading consumer of Group III base stocks. Consequently, as challenges in the exports market intensify, a greater portion of Asian Group III will remain within the region, providing an opportunity to blenders to catalyze the shift toward better quality lubricants.

Overall, Kline estimates that about 4.5-4.8 kilotonnes of new base stock capacity will be created over the next five to 10 years as announced by several suppliers. Most of this new capacity will be dedicated to Group II base stocks spread across Europe, Asia-Pacific and the Middle East. This can potentially alter the Group II dynamics in Europe, which until now has had lower penetration. Moreover, indigenous Group II capacity in the Middle East would trigger greater usage within the region. China, a large importer of base stocks, continues to add more Group II. The Group II surplus in North America will play a greater role in South America and will help address the Group I deficit.

Currently there is no major Group III capacity planned besides select partial upgrades by a few plants. This will help clear the glut in the global Group III production as the demand for Group III base stocks grows rapidly. Within the Group III base stocks market, there is a growing preference for high viscosity index (VI) base stocks—referred to as Group III+ by marketers—which can offer VI in excess of 130. These base stocks will play a greater role in formulating engine oils.

On the other hand, naphthenic supply will grow in line with its demand in the form of improved operating rates more than new capacity creation.

So what does this bode for the Group I market? Group I producers are under strain from declining technical demand for Group I and growing competition from Group II and III base stocks, especially in the lighter viscosity grade range. Kline forecasts that around 4.5-5.0 million tonnes of capacity needs to be rationalized over the next 10 years to bring a long-term supply-demand balance in the global market. Much of this will be in the form of high-cost Group I capacity.

While Group I will be substituted from automotive applications, it will hold on to its industrial applications, particularly the ones in the high viscosity range. The growing shortage of high viscosity base stocks would mean that these grades fetch premium prices, which provides additional margin to producers. Applications that value additive solubility and viscosity will continue to greatly prefer Group I base stocks.

In conclusion, the new base stock supply creation will outpace the new demand growth. While the changing base stock market is challenging some players, it is creating opportunities for others. It is clear that the market for Group II, III and synthetic base stocks is expanding, and the market for Group I is declining. It will be a while before the glut in global base stock supply is cleared. This will partly be achieved by capacity shutdowns. The plants that manage to survive this change will be determined by their cost position, target geography, market integration (backward and forward) and prices of byproducts.

Anuj Kumar is a project manager at Kline & Co. in the Energy practice. You can reach him at Anuj.Kumar@klinegroup.com

Anuj Kumar is a project manager at Kline & Co. in the Energy practice. You can reach him at Anuj.Kumar@klinegroup.com.

Kline is an international provider of world-class consulting services and high-quality market intelligence for industries including lubricants and chemicals. Learn more at www.klinegroup.com.