Heavy-duty diesel lubricants: How will they address fuel economy in the future?

Jeanna Van Rensselar, Senior Feature Writer | TLT Feature Article September 2016

The imminent availability of PC-11 lubricants is a focus on fuel efficiency for HD vehicles.

© Can Stock Photo Inc. / ziss

KEY CONCEPTS

•

PC-11 standards will achieve a 9%-23% reduction in emissions and fuel consumption from affected HD vehicles over 2010 baselines.

•

Lower viscosity equals lower CO

2 emissions and improved fuel efficiency. Through additives, formulators have been able to lower viscosity without compromising performance and durability, but there is still a limit as to how low viscosity can go.

•

Because PC-11 lubricants are new and the understanding of how they perform is not yet complete, experts say oil analysis may be more important than ever.

AS MUCH AS 30% OF THE OPERATING COSTS OF A COMMERCIAL TRUCK FLEET are attributed to fuel. A 1% increase in fuel economy might not seem like a lot, but it would result in significant reductions in both fuel consumption and CO

2 emissions.

If every U.S. truck increased its fuel economy by just 1%, it could save fleet and owner operators combined an estimated $2.5 million a day and reduce annual CO

2 emissions by four million tons—this is the equivalent of removing 23,000 trucks from the road (

see Cummins Rock Solid Rules for Trucks and Fuel Economy) (

1).

In addition to private fleet owners, one of the major beneficiaries of improved fuel consumption in heavy-duty (HD) vehicles is the military (

2). Fuel consumption is a significant burden—not just in cost but more so in terms of logistics. More fuel-efficient military vehicles would be able to operate with less fuel on the battlefield, which would mean a greater range of operation without refueling in highly volatile conditions.

CUMMINS ‘ROCK SOLID RULES’ FOR TRUCKS AND FUEL ECONOMY (3)

•

Every 2% reduction in aerodynamic drag results in approximately 1% improvement in fuel economy.

•

Above 55 mph, each 1-mph increase in vehicle speed decreases fuel economy by 0.1 mpg.

•

Worn tires provide better fuel economy than new tires, up to 7% better fuel economy.

•

Used lug drive tires can get up to 0.4 mpg more than new lug tires.

•

Ribbed tires on the drive axles provide 2%-4% better fuel economy than lugged tires.

•

Every 10 psi that a truck’s tires are underinflated reduces fuel economy by 1%.

•

The break-in period for tires is between 35,000-50,000 miles.

•

Tires make the biggest difference in mpg below 50 mph; aerodynamics is the most important factor over 50 mph.

•

The most efficient drivers get about 30% better fuel economy than the least efficient drivers.

•

Idle time is costly. Every hour of idle time in a long-haul operation can decrease fuel efficiency by 1%.

Dan Arcy, global OEM technical manager, Shell Lubricants, and chairman of the Proposed Category 11 (PC-11) New Category Development Team, says that improvements in fuel economy for HD vehicles have been gradually taking place. “In a lot of respects, we have been working on fuel economies for HD vehicles for a long time,” he says. “We have seen a trend over the years of looking at everything that contributes to fuel consumption. I remember when trucks rarely turned off; they were either driving or idling the whole time. Fleet owners started to look at those things—where they were wasting fuel. So, for example, we are seeing auxiliary power units that reduce the amount of idle time while still allowing the driver to stay comfortable.”

OEMs, aftermarket customizers and fleet owners themselves have made improvements through low-rolling resistance tires, aerodynamic design changes and add-ons, automatic tire inflation systems, driver training and idle management.

One way to improve fuel efficiency is by lowering viscosity. But the challenge continues to be:

How do we do that without compromising engine durability and performance?

WHY NOW?

The existing CJ-4 oil specification, introduced in October 2006, has been the standard longer than nearly all diesel engine oil categories. In 2010 the National Highway Traffic Safety Administration together with the EPA announced regulations that would reduce the level of greenhouse gas (GHG) emissions and require fuel economy improvements for medium- and heavy-duty vehicles. The new regulations, which are being phased in from 2014-2018, impose fuel-efficiency targets based on the vehicle’s size and weight. The toughest GHG regulations will be enforced in 2017 (

see U.S. Emission Regulations).

U.S. EMISSION REGULATIONS

The greenhouse gas and fuel economy standards that were jointly issued by EPA and the National Highway Traffic Safety Administration in 2011 mandate reduction of CO

2 emissions and fuel consumption in medium- and heavy-duty vehicles. Emissions and fuel economy standards vary by model year and vehicle class. In general the target is up to 20% improvement over baseline 2010 model-year vehicles. Tougher standards have already been proposed that will require even better fuel economy over the next 10 years.

Vehicles impacted include combination tractor/trailers, pickup trucks, buses, vans and vocational service vehicles. Together these vehicles are the U.S. transportation segment’s second-largest and fastest-growing contributor to oil consumption and GHG emissions. The heavy-duty sector addressed in these joint rules accounts for nearly 6% of all U.S. GHG emissions.

These final standards will achieve a 9%-23% reduction in emissions and fuel consumption from affected tractors over 2010 baselines (

4).

Certain semitrucks will be required to achieve up to 20% reduction in fuel consumption and GHG emissions by model year 2018, saving up to four gallons of fuel for every 100 miles traveled (

5).

API PC-11 is a new generation of HD engine oils that will facilitate compliance with the new regulations (

see PC-11 Sequence Tests). The date of first license for PC-11 oil, now called API CK-4 and API FA-4 oils, is Dec. 1. To comply with these new regulations, there have already been significant diesel engine design changes such as:

•

Diesel engine downsizing: 15 L to 13 L

•

Down speeding: 1,600 rpm to 1,200 rpm

•

Advanced combustion design

•

Active oil temperature control

•

Variable valve timing

•

Start/stop technology (

6).

PC-11 SEQUENCE TESTS

There are seven engine sequence tests that have been carried over from the current API CJ-4 category and two new sequence tests that have been added: Volvo T-13 and Caterpillar Oil Aeration Test. These nine tests are as follows:

•

Mack T-11. Evaluates a lubricant’s ability to mitigate soot-related viscosity increase.

•

Mack T-12. Measures the engine oil’s ability to protect against ring and liner wear.

•

Caterpillar 1N. Evaluates engine oils for certain high-temperature performance characteristics such as the ability to protect against carbon and lacquer deposit formation with aluminum pistons and oil consumption.

•

Caterpillar C13. Tests piston deposit and oil consumption with iron pistons (

see Figure 1).

•

Cummins ISB. Evaluates the engine oil’s ability to prevent slider valve-train wear.

•

Cummins ISM. Evaluates an engine oil’s ability to protect turbocharged, after-cooled four-stroke cycle diesel engines equipped with EGR against valve-train wear, filter plugging and deposit formation under soot conditions.

•

RFWT. Roller-follower wear test to evaluate soot-induced wear in roller-followers.

•

Volvo T-13. Evaluates engine oil’s resistance to oxidation and bearing corrosion.

•

Caterpillar Oil Aeration Test. This is an aeration test to evaluate the oil’s ability to resist/release entrained air.

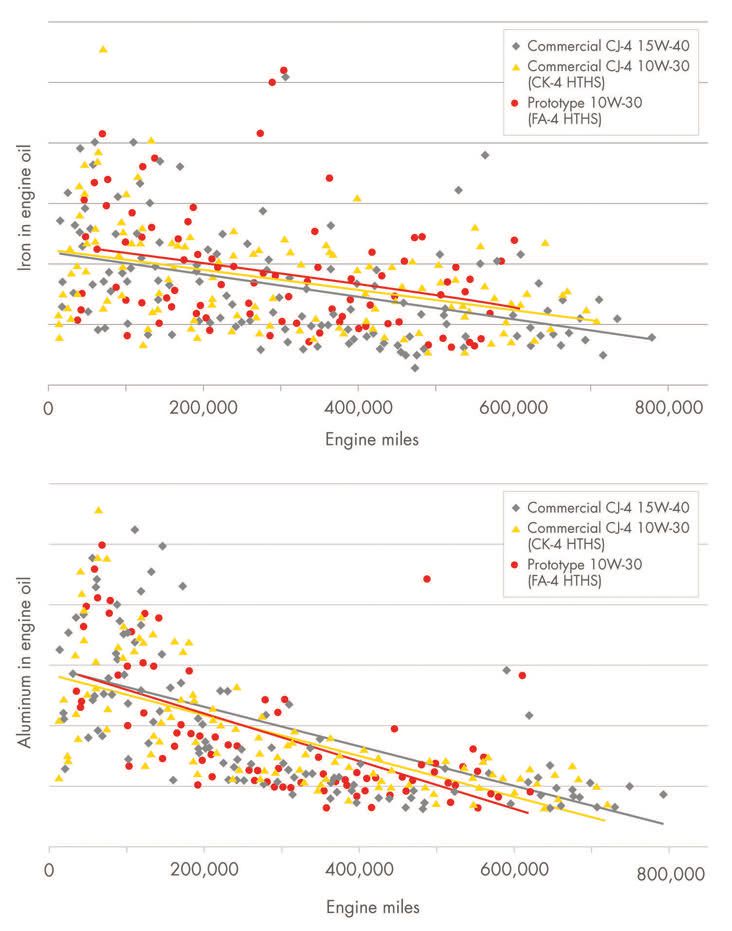

Figure 1. The wear rates for iron (top) and aluminum (bottom) were nearly identical for all three oils. In all three cases, microscopic wear particles show early break-in wear followed by a reduction to a consistent low wear rate. (Graphic courtesy of Dan Arcy and Shell.)

Figure 1. The wear rates for iron (top) and aluminum (bottom) were nearly identical for all three oils. In all three cases, microscopic wear particles show early break-in wear followed by a reduction to a consistent low wear rate. (Graphic courtesy of Dan Arcy and Shell.)

The new PC-11 diesel engine oils will play a pivotal role in supporting new design changes and complying with new regulations by increasing fuel economy through lower viscosity grades and improving engine durability through advanced additive formulations and careful base oil selection.

The Engine Manufacturer’s Association (EMA) requested that the new category for lubricants be split into subcategories, one that meets current heavy-duty criteria (> 3.5cP high-temperature high-shear [HTHS]) (

7) and one that provides fuel efficiency benefits while maintaining durability (decreased HTHS) (

see Figure 2). The proposal presented by the EMA includes performance specifications to address:

•

Improved oxidation stability

•

Compatibility with and protection from biodiesel

•

Better aeration control

•

Better protection against scuffing/adhesive wear

•

Improved shear stability.

Figure 2. No discernible difference in wear was observed between engines using the prototype low-HTHS viscosity oil and the two higher viscosity oils. In fact, the engine using the prototype oil had a notable lack of wear. The cam lobe, piston and wrist pin bushings pictured here were observed to be in a very good state after running for 520,398 miles with the prototype oil. The contact areas of these components are critical for wear protection, as they are subjected to extreme pressures with high heat and friction. (Photo courtesy of Dan Arcy and Shell.)

Figure 2. No discernible difference in wear was observed between engines using the prototype low-HTHS viscosity oil and the two higher viscosity oils. In fact, the engine using the prototype oil had a notable lack of wear. The cam lobe, piston and wrist pin bushings pictured here were observed to be in a very good state after running for 520,398 miles with the prototype oil. The contact areas of these components are critical for wear protection, as they are subjected to extreme pressures with high heat and friction. (Photo courtesy of Dan Arcy and Shell.)

It was after receiving the request and conducting preliminary research that the API determined the need to establish two new performance categories.

SPECIFICATION PROCESS

The development and approval of an engine oil is a three-phase process:

•

Phase 1. The New Category Evaluation Team (NCET) is formed, which consists of manufacturers (EMA), oil marketers (API) and additive companies (American Chemistry Council). The focus of the NCET, through a consensus process, is to review the request and evaluate the need for a new specification.

•

Phase 2. The New Category Development Team (NCDT) is formed to oversee the specification and test method development and to agree to any additional guidelines. The NCDT is structured with four functional work groups (API, ASTM, ACC and EMA) that report to the NCDT. Each of the four groups has specific responsibilities. In addition, ad hoc work groups from SAE and engine test laboratories are asked to participate. The NCDT uses a consensus process to develop the category. Once the category and the tests have been defined, the first licenses are scheduled for issuance.

•

Phase 3. This is the category implementation (

8).

Shell has played a leading role in the development of the new engine oil categories, with Arcy serving as NCDT Chair.

“Anyone can request a new category and ask API to develop one,” Arcy explains. “With PC-11 the request was for a new performance standard to protect next generation engines that would reduce GHG emissions and provide improvements in fuel economy. In this case there was a need for improved oxidation protection, aeration control, improved shear stability and thinner oils for fuel economy. There also was a request for biodiesel compatibility, but the NCET didn’t see that as a challenge that needed to be addressed. So that was removed. The team reviewed the requests and made a recommendation.”

He continues, “We had meetings every six weeks or so. Phase 1 took six months; Phase 2 took four years. During that time ASTM determined standards for tests and composed the pass/fail limits for each.”

TWO NEW CATEGORIES

PC-11 introduces two new performance standards (

see Figure 3):

•

CK-4. Oils that provide increased engine protection at traditional viscosities—maintaining the performance of CJ-4 oils in higher viscosity grades, such as 15W-40 (

see Figure 4). These oils would provide additional oxidation stability, resistance to aeration, scuffing and adhesive wear and increased shear stability.

o

Licenses on Dec. 1, 2016

o

Is backward compatible with API CJ-4, API CI-4+, etc.

o

Covers XW-40 and XW-30 viscosity grades (X = 0, 5, 10 or 15)

o

Minimum 3.5 cP HTHS

o

Has the same limits on sulfur, phosphorus and sulfated ash as CJ-4

o

Is compatible with after-treatment systems.

Figure 3. A quick overview of two new PC-11 engine oils. (Graphic courtesy of Dan Arcy and Shell.)

Figure 3. A quick overview of two new PC-11 engine oils. (Graphic courtesy of Dan Arcy and Shell.)

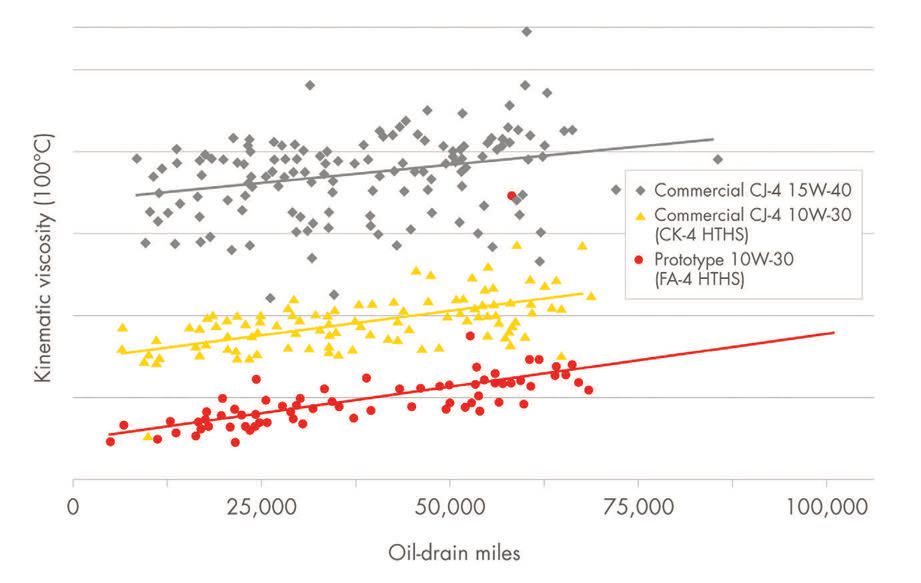

Figure 4. The rate of viscosity increase throughout the oil-drain interval is similar for all three oils (shown by the similar gradient of the lines). Oxidation is a major cause of viscosity increase, which indicates oil aging. (Graphic courtesy of Dan Arcy and Shell.)

Figure 4. The rate of viscosity increase throughout the oil-drain interval is similar for all three oils (shown by the similar gradient of the lines). Oxidation is a major cause of viscosity increase, which indicates oil aging. (Graphic courtesy of Dan Arcy and Shell.)

•

FA-4. Oils at lower viscosities that yield better fuel economy and meet the same performance requirements (but might compromise protection in older engines, thus limit backward compatibility).

o

Licenses on Dec. 1, 2016

o

Has limited or no backward compatibility—any backward compatibility depends on the OEM

o

Covers only XW-30 viscosity grade (X = 0, 5 or 10)

o

Has a viscosity range between 2.9-3.2 cP HTHS

o

Has improved fuel economy compared to API CJ-4 and CK-4 oils

o

Has the same limits on sulfur, phosphorus and sulfated ash as CJ-4

o

Is compatible with after-treatment systems.

Both CK-4 and FA-4 oils can help reduce CO

2 emissions and maintain engine durability while improving oxidation resistance, shear stability and aeration control.

Phil Ames, heavy duty engine oil marketing manager for Afton Chemical Corp. in Richmond, Va., says, “Afton has made significant investments in research and development to design new chemistry to meet—and exceed—the performance and durability requirements of these new FA-4 oils and as such I would suggest fuel economy has been and will remain one of Afton’s highest priorities in heavy-duty engine oils.”

According to a recent Commercial Carrier Journal survey, almost 48% of respondents are slightly to very concerned about the implementation of PC-11. Respondents’ top concerns included:

•

The fear that lower viscosity oils will increase engine wear

•

The possibility of needing both API CK-4 and FA-4 oils

•

Determining the right oil for their fleet

•

Not being able to use the new formula in older engines and what will happen if it is used in older engines (

9).

“OEMs are working to determine if there is backward compatibility,” Arcy explains. “One of the challenges is going to be fleets that have a range of ages of vehicles and manufacturers. CK-4 should be no problem. The challenge is going to be FA-4. Will those FA-4 oils be acceptable for use in older engines? We are going to have to wait and see what each manufacturer says.”

BASE STOCK AND ADDITIVES

One of the primary catalysts for PC-11 oils was OEMs that wanted an oil with significantly better protection against wear and oxidation. This, in turn, compelled oil formulators to incorporate new additives into more stable base oils.

PC-11 base stock can run the range of mineral oil, semisynthetics and synthetics. Base oil selection will depend on oil performance tier and viscosity grade.

There is some overlap in additive packages for CK-4 and FA-4 oils; most PC-11 oils will include at least two classes of additives: viscosity index (VI) improvers and antioxidants.

1. VI improvers. These account for 23% of all additive sales. VI improvers are the preferred technology for optimization of lubricant and hydraulic fluid viscosity behavior in both low-temperature vehicle and equipment start-ups and high-temperature operations. VI improvers help strike the optimal balance of thickening efficiency and shear stability in a variety of base stocks and more recently have begun to serve as an important design tool in improving fuel and energy efficiency. In addition to their lubricant thickening powers, VI improvers impart mechanical, thermal and oxidative stability as well as dispersancy.

The basic functions of viscosity modifiers are:

•

Reducing viscosity changes with temperature

•

Enabling the engine to start at low temperatures

•

Ensuring engine durability during boundary layer lubrication regimes

•

Providing non-viscometric performance benefits

•

Providing protection and better operation for a secondary usage of engine oil, including removing contaminants to the filter, preventing rust and corrosion and in some cases transmitting power.

2. Antioxidants. Sacrificial antioxidants deplete over time and include:

•

UV absorbers

•

Peroxide decomposers

•

Chain-breaking electron donors

•

Chain-breaking electron acceptors.

Primary antioxidants include:

•

Phenolic or aromatic amines

•

Chain-breaking antioxidants

•

Free radical-absorbing antioxidants (able to stop more than one free radical).

Secondary antioxidants include peroxide decomposers. Other major additives can include dispersants, detergents, pour-point depressants, foam inhibitors, corrosion inhibitors and antiwear additives.

Following is the range of additive treat rates for HD engine oil:

•

Ashless dispersants: 8%-12%

•

VI improvers: 0%-10%

•

Detergents: 2%-3%

•

Antioxidants: 0.3%-1.5%

•

Antiwear additives: 1%-1.5%

•

Others: 1%-2%.

Greg Shank, executive staff engineer coordinator: fluids technology for Volvo Group Trucks Technology, explains that the oxidation and aeration performance improvement in CK-4 and FA-4 oils is very important for engine protection and maintenance intervals.

Jackie Liu, global business director, engine oils for Evonik Oil Additives, says, “We need to take a very close look at every component in the lubricant formulation and its value. In this way, it should be possible to maximize the value of all of the components that make up today’s heavy-duty diesel lubricants. For example, viscosity index improvers can be formulated with additional functionality, such as dispersant, or improvements in film thickness. Allowing key components in lubricants to address multiple concerns will allow lubricant formulators greater flexibility, leading to improvements in the efficiency of the hardware/lubricant combinations that are not available today.”

DURABILITY/VISCOSITY TRADE-OFF

Engine oils contribute to fuel economy in two ways:

•

As an enabler by providing the high-performance protection that allows changes to engine design and after-treatment technology without affecting fuel economy.

•

As a direct contributor through formulation changes that maximize fuel economy.

While fuel economy for passenger cars has been a design consideration for decades, this is not true for heavy-duty diesel engines (

see The Source of Friction). Now that the industry seems to have reached the point of diminishing returns in the area of reducing diesel exhaust gas emissions, the emphasis is back on fuel economy (

11). PC-11 FA-4 oils are focused on enhanced fuel efficiency with HTHS viscosity being the main determinant of fuel economy performance (

see Kinematic Viscosity Versus HTHS Viscosity).

THE SOURCE OF FRICTION (10)

Friction is the enemy of fuel economy. Many researchers have studied the frictional contribution of individual engine components both theoretically and through laboratory engine tests. The consensus is that the engine components resulting in the majority of engine friction are the piston ring assembly, valve train system, bearing system and engine powered auxiliaries (such as the water pump, oil pump, fuel pump and alternator).

•

Piston ring assembly (PRA) friction. The piston ring assembly consists of the piston rings, piston skirt and liner. This is the site of the majority of engine friction. PRA friction may best be characterized by the simple reciprocating motion of the piston within the liner, leading to areas of mixed and boundary lubrication followed by stretches of hydrodynamic lubrication in between. The high in-cylinder pressure due to combustion promotes higher friction due to greater normal forces between the rings and liner.

•

Valve train friction. Major sources of valve train friction include the cam/follower interface, cam bearings, rocker arm axles/pivots and friction between tappets and their bores. The cam interface, tappet and bore friction account for the majority of this friction.

•

Bearing friction. Loads on main bearings and rod bearings vary in both magnitude and direction because they result from in-cylinder pressures as well as inertial loads from piston/connecting rod accelerations and decelerations.

•

Engine-powered components. Internal engine friction originates in the fuel pump, coolant pump and oil pump. Due to the low loads and high-operating speeds of these pumps, the majority of the friction losses are due to fluid friction.

© Can Stock Photo Inc. / Zalias

© Can Stock Photo Inc. / Zalias

KINEMATIC VISCOSITY VERSUS HTHS VISCOSITY

Kinematic viscosity is a common measure of the fluid’s resistance to flow and shear under forces of gravity—how easily the oil flows to the different parts of the engine. High-temperature high-shear (HTHS) viscosity is an indicator of an engine fluid’s resistance to flow in the passages between fast moving parts in fully warmed up engines. HTHS is a much more useful measure of what happens to the oil in the engine. It is HTHS viscosity that is a critical property and that will distinguish backward compatible CK-4 oils from fuel economy FA-4 oils for newer engines. Lower HTHS viscosity improves fuel economy and lowers greenhouse gases, but higher HTHS viscosity has better wear protection.

“While viscosity does play a critical role in preventing metal-to-metal contact and wear, it is not the only factor that impacts wear and durability,” Ames says. “The additive package also plays a critical role in maintaining durability and contains chemistry that helps prevent wear. Additive packages can be designed with more robust antiwear performance to help offset debits from lighter viscosity base oils.”

Because the oil pump in the engine suctions the oil out of the oil pan and circulates it around in the engine to provide lubrication, the more viscous that oil is the more fuel-draining energy it takes to pump the oil. So it just makes sense that lowering the viscosity saves fuel. However, the oil still needs to be thick enough to protect the engine and prevent wear. FA-4 oils are being formulated in a way that allows reduced viscosity without sacrificing durability.

Lower-viscosity oils for HD engines have already been adopted in Europe, where the most widely used grade is 10W-40, and they are moving to 5W-30 in many cases, particularly in winter operations (

12).

So just how low can viscosity go?

“One issue is lower oil pressure,” Shank says. “Some components are impacted by oil pressure. This is not a wear issue, but oil pressure limits may be different for CK-4 and FA-4. Today we would say the floor for HTHS viscosity is 2.9 HTHS (FA-4). Maybe lower in the future, but it’s too soon to predict.”

Liu says, “We recognize that while fuel economy is critically important, it cannot be achieved at the expense of durability. As such, we work diligently with our partners to enable durable long‐life lubricants with enhanced low-temperature viscometrics and superior fuel economy.”

Liu continues, “It has been demonstrated that by optimizing viscosity across a broad range of temperatures significant fuel economy can be achieved without compromising durability. However, much heritage hardware cannot benefit from such technology. Redesigning heritage hardware is not practical, but designing new hardware with the new lubricant technology as a design element will permit significant improvement of fuel economy and will maintain or even exceed the durability of today’s lubricants.”

The formation of air bubbles in an oil formulation. (Photo courtesy of Dan Arcy and Shell.)

The formation of air bubbles in an oil formulation. (Photo courtesy of Dan Arcy and Shell.)

Ames adds, “OEMs will need to assess whether FA-4 oils are suitable for use in each engine type and application. While FA-4 oils must pass the same challenging wear tests as CK-4 oils in order to be API licensable, they still must be assessed for suitability of use in heritage engines.”

Analysis of used FA-4 oil is extremely important for two reasons: to ensure the correct oil is being used and to monitor wear metals, which could be an issue with FA-4 oils in older engines.

“One of the things that I recommend is oil analysis, because fleets are running some long drain intervals and you want to detect potential issues early on,” Arcy says. “With new engines and new oil coming out and the long drain intervals, we want to understand how these oils are performing and watch for oil contamination.”

The U.S. has already proposed a Phase 2 GHG emissions standard which, if approved, will continue to drive CO

2 emissions down and improve fuel efficiency. “So the shift to lighter viscosity oils in the name of fuel economy will very likely continue just as we have seen in the passenger car market,” Ames says.

Liu concludes, “Within the framework of improved resource efficiency and reduced overall cost of operations, today’s lubricants must meet the equipment owner’s and operator’s needs. These include continuous improvement of lubricant quality, exemplified by extended drain intervals, improved oxidation control and superior aeration performance.”

REFERENCES

1.

From

Shell’s Preparing for API CK-4 and FA-4: What the New Categories Mean for You and Your Heavy-Duty Engines. Available

here.

2.

Since more than 95% of all heavy-duty trucks are diesel-powered, the term heavy-duty lubricants in this article refers to lubricants for heavy-duty diesel vehicles.

3.

From

here.

4.

From

EPA and NHTSA Adopt First-Ever Program to Reduce Greenhouse Gas Emissions and Improve Fuel Efficiency of Medium- and Heavy-Duty Vehicles. Available

here.

5.

From

Greenhouse Gas Emissions Standards and Fuel Efficiency Standards for Medium- and Heavy-Duty Engines and Vehicles. Available at

www.nhtsa.gov/fuel-economy.

6.

From

PC-11 Explained. Available at

http://pc-11explained.com/pc-11-explained.html.

7.

Centipoise high-temperature high-shear.

8.

From

Shell’s Preparing for API CK-4 and FA-4: What the New Categories Mean for You and Your Heavy-Duty Engines. Available

here.

9.

From Chevron’s

PC-11 Explained website. Available at

http://pc-11explained.com/.

10.

From

An Introduction to Heavy-Duty Diesel Engine Frictional Losses And Lubricant Properties Affecting Fuel Economy – Part I. Available

here.

11.

From

The Lubricant Contribution to Improved Fuel Economy in Heavy Duty Diesel Engines (abstract). Available at

http://papers.sae.org/2009-01-2856/.

12.

Ibid.

Jeanna Van Rensselar heads her own communication/public relations firm, Smart PR Communications, in Naperville, Ill. You can reach her at jeanna@smartprcommunications.com

Jeanna Van Rensselar heads her own communication/public relations firm, Smart PR Communications, in Naperville, Ill. You can reach her at jeanna@smartprcommunications.com.