Base Oil Groups: Manufacture, Properties and Performance

Stuart F. Brown, Contributing Editor | TLT Webinars April 2015

A detailed look at mineral, synthetic and even renewable oils and the manufacturing processes used to make them.

www.canstockphoto.com

KEY CONCEPTS

•

Pour point, viscosity, viscosity index and purity are the four physical properties that describe base oils and dictate how they will perform in service.

•

Base oils are classified by API into five groups according to their ingredients and performance characteristics.

•

Hydroprocessing is a method that typically uses three catalytic reactors to produce Group II and Group III base oils.

MEET THE PRESENTER

This article is based on a Webinar originally presented by STLE University on Oct. 8, 2014. “Base Oils Groups I-V: Manufacturing, Properties and Performance” is available at

www.stle.org: $39 to STLE members, $59 for all others.

John Rosenbaum has a bachelor’s degree in chemistry from San Diego State University and a doctorate in materials science and mineral engineering from the University of California at Berkeley. He is the senior project development engineer at Chevron Global Base Oils in Richmond, Calif., where he has spent 33 years. He has 18 years of experience researching catalysts and process technologies, fuels and lubricant base oils. He is also responsible for spearheading Chevron’s experimental program to make liquid fuels and lubricant base oil from natural gas and worked on the ISODEWAXING® Catalyst System. He is the author/co-author of over 60 U.S. Patents and several publications. You can reach John at

rosenbaum@chevron.com.

John Rosenbaum

John Rosenbaum

AUTOMOBILE AND TRUCK ENGINES ARE THE WORLD'S BIGGEST CONSUMERS OF LUBRICANTS, going through 20 million tons per year, which is about half of total lubricant use. With vehicle makers pushing endlessly to meet stiffening efficiency and pollution standards, the automotive market drives the way oil companies produce base oils, which account for the lion’s share of the volume of a bottle of motor oil.

Analyze the contents of a quart of motor oil and you will discover that approximately 75%-85% of its volume consists of base oil. The remainder is a package of additives that confers properties essential to protecting the moving parts of gasoline and diesel engines. Viscosity modifiers, antioxidants and corrosion inhibitors are a few of the ingredients ensuring that modern motor oils meet the auto industry’s performance specifications.

Both the additives and the base oil contribute to the oil’s ability to protect the bearings, piston rings and other rotating and reciprocating engine parts requiring continuous lubrication. STLE-member Dr. John Rosenbaum, senior project development engineer at Chevron Global Base Oils, says, “The base oils themselves confer important properties to lubricants and are much more than mere carriers for other ingredients.” The information in this article derives from an STLE Webinar on base oils that Rosenbaum delivered on Oct. 8, 2014, titled “Base Oils Groups I-V: Manufacturing, Properties and Performance.” He covered mineral, synthetic and even renewable lubricants oils, and the manufacturing processes used to make them.

Base oils are described by four physical properties that dictate how they will perform in service:

1.

Pour point. The lowest temperature at which a sample of oil can be poured determines the pour point.

2.

Viscosity. An oil’s resistance to flow defines the viscosity. Honey, for example, is more viscous than water.

3.

Viscosity index (VI). As an oil’s temperature changes, so does its viscosity, defining its VI. A high-VI oil, for example, changes viscosity less with temperature than a low-VI oil. The multigrade engine oils specified by vehicle makers require high-VI base oils as a starting place in the formulation process. High-VI base oils have lower volatility and are designed to operate at low as well as high temperatures.

4.

Purity. Constituents of many lubricants such as sulfur, nitrogen and polycyclic aromatic compounds must be held within strict limits.

CLASSES OF BASE OILS

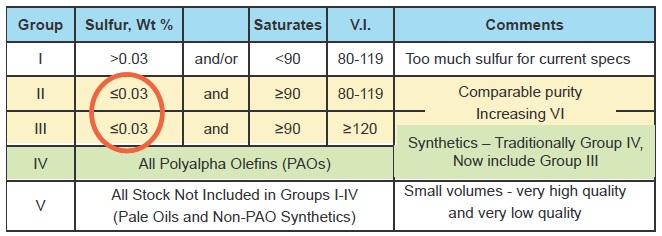

Base oils are classified by the American Petroleum Institute into five groups (

see Figure 1) according to their ingredients and performance characteristics.

Figure 1. Classification of base oils.

Figure 1. Classification of base oils.

Group I base oil stocks contain greater than 0.03% sulfur, less than 90% saturates and have a VI ranging from 80-119. Demand for Group I oils is declining, although they are still the largest single category in the global market. These oils are falling out of favor because they contain too much sulfur and aromatics to be as stable as hydroprocessed oils. They are commonly used in industrial and marine lubricants and in engine oils for older engines.

Groups II and III are both hydroprocessed oils with comparable purity and typically 99% saturates. The big difference between them is that Group III has a VI of 120 or greater. More than 90% of all the volume of lubricants in the world can be made from Group II oils, which are really the base stock workhorses—especially in North America—where Group II dominates the base oil supply. Group II oils come into their own when a higher VI, along with low volatility, is needed. The Group IIIs are growing in use as fuel economy lubricants become more important and car makers use 0W-20 oils for the “factory fill” of newly assembled engines. 0W-16 oil is already being used in some new engines and Japanese car makers have expressed a wish to see viscosity continue to drop to 0W-12, 0W-8 and even 0W-4. Group III also includes gas-to-liquid (GTL) oils made from natural gas using a process developed in the 1920s by the German chemists Franz Fischer and Hans Tropsch. Shell is operating a large GTL plant in Qatar, but the method remains a complex one requiring a large investment in process equipment.

Group IV consists of polyalphaolefins (PAOs), which are the traditional synthetic stocks. By using mixtures of different alphaolefins, formulators can create oils with a VI as high as 140. The use of these oils is severely limited by the cost and availability of feedstocks, which face competition from other applications. As a result, the Group IVs are destined to remain a niche category.

Group V embraces everything else, ranging from some very low-quality naphthenics all the way up to some very exotic synthetic oils. Other occupants of this group are organic esters, compressor oil, some biodegradable fluids and the polyalkylene glycols that are extremely non-flammable and thus suited for use as high-temperature hydraulic fluid.

MANUFACTURING PROCESSES

Group I oils are produced by solvent extraction and dewaxing processes. Solvent extraction starts with a heavy refinery feedstock from a crude distillation unit that’s called vacuum gas oil. A very selective solvent removes much of the sulfur, aromatic and nitrogen compounds. The resulting oil stream comes out of the extractor still containing paraffins that need to be removed to make it a base oil. A light solvent is added and the mixture is refrigerated to a low temperature at which the paraffins precipitate and are filtered out. While the entire process is simple in concept, the maintenance and operating costs are relatively high.

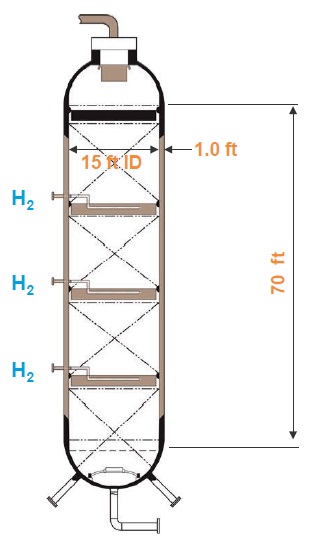

Hydroprocessing is a method that typically uses three catalytic reactors to produce Group II and Group III base oils. The process begins with the same vacuum gas oil feedstock as Group I, but runs it through a hydrocracker at very high pressures, frequently above 2,000 pounds per square inch. The hydrocracker reshapes the molecules, saturating a lot of the aromatic compounds with hydrogen, which improves their stability. It converts sulfur into hydrogen sulfide gas and nitrogen into ammonia, creating a product called a waxy base oil that’s a lot cleaner than the output of a solvent extraction and contains more than 90% saturated compounds.

The second reactor is a catalytic dewaxer (also knowns as a hydroisomerization unit), where the wax molecules are converted to isoparaffins and even more saturation occurs. Finally there is a lower temperature but very high-pressure finishing step in which the final few percent of residual aromatic compounds are saturated to form Group II base oils. A more severe hydrocracking process is used to produce Group III oils.

A large hydrocracker is an imposing piece of hardware. Chevron’s new Group II base oil plant in Pascagoula, Miss., (

see Figure 2) has hydroprocessing reactors that are 70 feet tall, 15 feet in diameter and have walls a foot thick. Inside are three catalyst beds that remove sulfur and nitrogen from the feedstock and saturate it with hydrogen pressurized to 2,000 pounds per square inch (

see Figure 3). The plant produces 25,000 barrels of base oil per day. “Through the magic of sophisticated catalyst technology plus some brute force high-pressure hydrogen, we just pound these molecules and convert almost all of the contaminating ones into pure hydrocarbons,” Rosenbaum explains.

Figure 2. Chevron’s new base oil plant in Pascagoula, Miss.

Figure 2. Chevron’s new base oil plant in Pascagoula, Miss.

Figure 3. Drawing of a large hydroprocessing reactor.

SYNTHETIC LUBRICANTS

Figure 3. Drawing of a large hydroprocessing reactor.

SYNTHETIC LUBRICANTS

Although they account for just 1%-2% of the volume of base oils produced, lots of interest in recent years has focused on synthetic base oils and on oils produced from renewable and rerefined feedstocks.

The traditional synthetics are PAOs for which there is a limited production capacity in the world. As a result, they are expensive and tend to find specialized applications where their unique properties such as good performance in very high- or low-temperature conditions make them the ideal choice. In general, PAOs can be quite stable and deliver very good performance under extreme conditions, hence they find uses in exotic applications such as spacecraft or at the top of tall windmills where very long-lasting lubrication is needed.

“Synthetics is really more of a marketing term than anything that conforms to a scientific definition,” says Rosenbaum. “The only place where a synthetic lubricant is really defined as a PAO is Germany. So there are a lot of other definitions of synthetics out there, and the buyer probably needs to beware of something that just calls itself synthetic or semisynthetic. What you really want is performance, and the sophisticated customer will look beyond the claim using the word synthetic to the actual performance service categories and OEM approvals.”

A synthetic can be thought of as something that is created, where the end material does not resemble the starting material. This applies to the PAOs and also to esters that are made from vegetable products, including canola oil. In the past 20 years, a new class of lubricants derived from vegetable oils has come on the scene. Traditional unmodified vegetable oils have long been used as lubricants, but their poor oxidation stability and the fact that they are often solid or nearly so at room temperature has made them poor performers.

Modified vegetable oils are usually esters, a type of synthetics that are frequently created by reacting a fatty acid derived from vegetable oil with an alcohol. Esters can have excellent low-temperature properties and stability. Vegetable oils can also be fed directly to a base oil refinery where oxygen is stripped off to create a paraffin that can usually be transformed to an isoparaffin. But the resulting molecules are fairly small, making the product a low-viscosity base oil.

Several of these biostocks are amenable to having their properties modified. Vegetable oils can be made into premium lubricants that may derive additional marketing advantages from being claimed as synthetic. The ultimate goal would be to make some of these natural feedstocks out of cellulosic biowaste like cornstocks or wood waste. Being able to utilize those kinds of products instead of food products for making base oils, however, will be a while in coming.

There are several other types of synthetic base stocks such as phosphate esters, polyalkylene glycols, alkylated aromatics and silicone oils, to name a few. Although these oils combined do not add up to 1% of the total global base oil market, there are important niche applications that require them.

REREFINED BASE OILS

Rerefined base stocks are another category generating a lot of buzz lately. “I remember when I was a teenager buying rerefined oil and putting it in my car,” Rosenbaum recalls. “I’m not sure there were any additives in it, and that it was not simply used oil which had been filtered. But in recent years, rerefined stocks have gotten quite good, if for no other reason than the starting material, high-quality engine oil, is often so much better. Some of the new rerefineries can turn out decent Group II base oil, although saturate content is frequently less than virgin Group II oil, and some customers have expressed concern over the variability of rerefined oil properties.” Another rerefinery product is “asphalt flux,” which can be mixed into asphalt for road paving in states that permit it.

When used motor oil is brought to a rerefinery, the first step is usually separating out the water that’s almost always in it. Sludge, consisting of soot and some of the heavier additives, is also separated, usually in some sort of short-path distillation process. Then the remaining oil is fed to a low-pressure hydroprocessing unit for a process known as hydrotreating. This process operates at 500-800 pounds of hydrogen pressure and saturates many of the aromatic compounds in the used oil. Sulfur compounds are transformed into hydrogen sulfide gas from which sulfur can be reclaimed.

One of the major challenges in rerefining is collecting the used oil. A rerefinery can have more than 100 trucks circulating in its area, gathering oil and delivering it to a central collection facility for refining. In several states, used motor oil is classified as a hazardous waste, which adds testing and documentation requirements. Rerefining can be a tough business. If fuel prices spike, trucks may have to follow shorter routes, which works against a refinery’s economies of scale.

There has also been a movement to closed-loop rerefineries. These are smaller facilities processing a couple of hundred barrels daily coming from dedicated customers such as large vehicle-fleet operators that bring them used oil for rerefining. The plants buy hydrogen by the truckload for the rerefining process, then blend the rerefined product with fresh oil and additives and return it for use in the vehicle fleet. There is the potential to realize significant operating cost savings through operating or purchasing from rerefineries. However, most fleet customers will need proof that engine oil quality can be maintained at a level required to satisfy OEMs standards through multiple rerefining cycles.

CONCLUSION

Having provided a tour of the boutique base stocks, Rosenbaum reminds us that about 98% of base oils are still derived from petroleum. The lion’s share of these are paraffinic or neutral oils derived from paraffinic crude stocks. About 15% of the world’s base oils are naphthenes or pale oils, composed largely of cyclic compounds made from naphthenic crude stocks.

As automotive lubricant specifications continue to evolve and the availability of feedstocks changes around the world, lubricant producers will need to stay on their toes to satisfy the demanding auto industry. Hydroprocessing will be the technology of choice in all significant new base oil plants due to the appeal of converting undesirable molecules into desirable ones, rather than just extracting the unwanteds. Hydroprocessing gives an operator much greater flexibility in running a plant and in selecting raw materials.

In spite of the market changes now underway, Group I still dominates, accounting for more than half the world’s base oil capacity. Many of the plants producing these oils are small and old, however, and will be shutting down in the next 20 years. Growth will be the trend for the Group II and Group III oils, which are certainly preferred in most automotive formulations. As demand increases for fuel-economy lubricants, the higher VI oils will have the advantage of being suitable for making low-viscosity lubricants while maintaining the needed volatility properties.

In closing, Rosenbaum encourages engineers to recognize the role base oils play in finished lubricants. “Additive technology is very important,” he asserts. “But selecting the right base oil is the first step in formulating a premium lubricant.”

Stuart F. Brown is a free-lance writer who can be reached at www.stuartfbrown.com

Stuart F. Brown is a free-lance writer who can be reached at www.stuartfbrown.com.