Truck fleets reach natural gas tipping point

Jeanna Van Rensselar, Contributing Editor | TLT Feature Article October 2013

Diesel is quickly being displaced as the fleet fuel of choice—and that means new rules for lubricants and fluid analysis.

KEY CONCEPTS

•

Large fleets are undergoing a major conversion to natural gas-powered engines.

•

Reasons for switching to natural gas include significantly lower cost, price stability, fewer noxious emissions and tax incentives.

•

Oil analysis for natural gas vehicles must factor in new considerations.

In the U.S., heavy-duty trucks and buses use more than 3-1/2 times as much diesel as all other vehicles combined. FedEx alone burns through about 1.5 billion gallons of diesel a year, and natural gas costs about a third less than diesel fuel. Given all this, it’s not surprising that the trucking industry is switching from petroleum to considerably cleaner-burning natural gas in a big way.

Both FedEx and UPS have made major commitments to significantly expand their natural gas-powered fleets over the next five years. The main reason is the much lower cost when compared with diesel, but other reasons include price stability, domestic availability and tax incentives. The major downside is the scarcity of refueling stations.

In April, Cummins began shipping engines capable of making long hauls on natural gas supported by a small network of refueling stations at fleet depots and truck stops. But the biggest commitment to natural gas vehicles so far was made by UPS, which just announced a significant expansion of its fleet of 18-wheel, natural gas-powered trucks from the 112 that are on the road now to about 800 by the end of 2014.

UPS chairman and CEO Scott Davis, says, “LNG (liquid natural gas) will be a viable alternative transportation fuel for UPS in the next decade as a bridge between traditional fossil fuels and emerging renewable alternative fuels and technologies that are not quite ready for broad-based long-term commercial deployment.”

Natural gas, which is primarily made up of methane and other hydrocarbon gases, is usually found above or below crude oil deposits, but sometimes it’s dissolved in the crude oil itself. There are also non-associated gas reservoirs that contain only gas and no oil. Although some property differences exist between natural gas and diesel (notably flammability and ignition temperature), natural gas vehicles (NGVs) operate pretty much the same as diesel-powered vehicles. The natural gas fueling station and pump are also about the same as a diesel station. The nozzle and receptacle are a little different, but an NGV can be just as easy and quick to fuel.

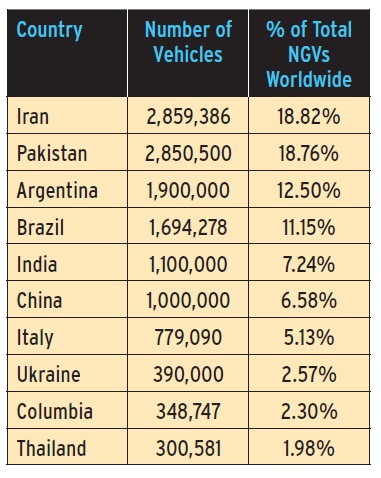

There are about 15 million NGVs (commercial and passenger) operating worldwide and about 120,000 NGVs in the U.S. The U.S. currently ranks 17th in the world with less than 1 percent of total NGVs. However, North America is expected to see some of the fastest growth due to abundant proven reserves and the low cost of domestically produced natural gas. NGVs are the most prevalent in the Middle East and Latin America—especially in those countries that lack a high capacity to refine oil. Per the Gas Vehicle Report, following are the countries with the most NGVs (

see table):

ADVANTAGES

One of the biggest advantages of NGVs is that they produce fewer harmful emissions. They can achieve as much as a 93 percent reduction in carbon monoxide emissions, a 33 percent reduction in emissions of various oxides of nitrogen and a 50 percent reduction in reactive hydrocarbons compared to a diesel-powered engine.

NGVs also have lower particulate matter 10 emissions (PM10 particles transport and deposit toxic materials through the air). NGVs that operate in diesel applications can reduce PM10 emissions by a factor of 10. The natural gas-powered Honda Civic Natural Gas passenger car has been recognized by the U.S. Environmental Protection Agency (EPA) as the cleanest commercially available, internal-combustion vehicle. NGVs also offer these benefits:

•

They are safer. The fuel storage tanks are denser and stronger than diesel or diesel tanks. An NGV fuel tank rupture in the U.S. has not occurred in more than two years.

•

Natural gas costs about a third less than diesel, and the price is much more stable than diesel.

•

Natural gas is convenient and abundant. In the U.S., there is a well-established pipeline network to deliver natural gas to almost every major urban area. While the U.S. imports more than 47 percent of its oil, 98 percent of its natural gas is produced in North America.

•

Because natural gas is clean-burning, NGVs have lower maintenance costs (i.e., fewer tune-ups).

•

They are quieter; heavy-duty natural gas vehicles have an 80- 90 percent lower decibel level than comparable diesels.

Another real benefit for fleet owners in the U.S. is the significant tax incentives offered by the federal and (some) state governments. For example, the Energy Policy Act (EPAct) of 2005, Public Law (PL) 109-58, stipulates an income tax credit equal to 30 percent of the cost of natural gas refueling equipment, up to $30,000 in the case of large stations and $1,000 for home refueling appliances. The credit went into effect Jan. 1, 2006 and currently is available until the end of 2013.

UPS: FIVE REASONS FOR NATURAL GAS

UPS says it will buy about 700 liquefied natural gas (LNG) vehicles and build four refueling stations by the end of 2014. The vehicles will use Cummins engines produced under a joint venture with Westmont Innovations. The company hopes to make natural gas vehicles a majority of its new heavy truck acquisitions over the next two years.

Jeff Yapp, UPS vice president of Global Automotive Engineering & Operations, offers five reasons for the shift toward NGVs:

•

Per the U.S. Energy Administration, LNG emits 25 percent less CO

2.

•

Fuel prices are now 30-40 percent lower than imported petroleum.

•

The growing domestic supply insulates natural gas prices from market volatility.

•

LNG does not compromise a tractor’s performance, fuel economy or driveability and significantly reduces greenhouse gases.

•

LNG tractors have a 500-mile range and no route limitations (except for available infrastructure).

“All of the Class 8 natural gas tractors will be used on our traditional over-the-road runs,” Yapp says. “This decision is the same whenever we purchase new tractors—to put the newest equipment on the longer runs. Because engine manufacturers have devised ways to have enough CNG storage on the tractor, the vehicles don’t have a range restriction. This also helps the ROI.”

UPS is benefiting from incentives provided by various states and the federal government, which offer tax credits and grants for installing natural gas fuel stations and using vehicles fueled by natural gas. The company currently operates about 112 LNG 18-wheel vehicles. Yapp adds that once the 700 additional LNG tractors are operational, UPS will save more than 17 million gallons of diesel fuel per year.

DISADVANTAGES

The following disadvantages are more applicable to some types of fleet vehicles and passenger cars, but they are not insurmountable:

•

Refueling. NGV fleet trucks that travel short daily routes don’t have refueling issues since the fleet depot will almost certainly have a natural gas fueling facility. But refueling is an issue for trucks that cannot get back to the depot during or at the end of the day. Some truck stops currently operate NGV refueling stations, but there are only 619 commercially available NGV refueling stations in the U.S., and most of these are for compressed natural gas (587), not the more fleet-friendly liquid natural gas (32). The U.S. Department of Energy maintains a NGV fueling station locator online.

•

Cost. In addition to the higher cost of new NGV fleet vehicles, there’s the cost of retrofitting existing fleet trucks to accommodate natural gas and the additional cost of fuel storage in some cases.

•

Storage. Although there are two different fuel storage options (depending on the type of natural gas), both require a lot more space than the diesel fuel tank. This is one of the hurdles for developing commercially viable passenger NGVs. With heavyduty trucks, the large storage tank isn’t as much of an issue.

The refueling and cost issues will take care of themselves as NGVs become more prevalent. And the storage issue is currently the focus of intense research.

CNG VS. LNG

CNG is natural gas compressed to less than 1 percent of its standard volume. Because it is highly pressurized, CNG requires special handling and storage. CNG requires cylindrical storage tanks that are much larger than those used for diesel and must maintain the fuel at pressures of up to 3,600 psi.

CNG is the most common form of natural gas used in NGVs. CNG vehicles are most prevalent in transportation fleets. In addition to public transit buses, other fleets include thousands of trucks at Waste Management, FedEx, UPS and AT&T. It makes the most sense for fleet vehicles that typically travel short distances.

CNG ADVANTAGES OVER LNG

•

Less expensive to produce

•

Unlimited hold time (no fuel loss)

•

Better developed technology

•

Simpler fuel tanks and fuel management

•

Customizable system design.

Liquefied natural gas (LNG) is created by cooling natural gas to -260 F at normal pressures, which condenses it into a liquid that is 0.0017 percent the volume of the gaseous form. The conversion of natural gas to LNG removes compounds such as water, CO

2 and sulfur from the raw material. The end product is a relatively purer methane that results in fewer air emissions. Because it is stable and non-corrosive in this form, LNG makes more sense for ocean tankers and anything else exposed to a highly corrosive environment. LNG requires large, dense and super insulated fuel tanks in order to keep the fuel cold. These specialized but necessary tanks add significantly to the vehicle cost.

LNG can directly replace diesel systems in heavy-duty trucks because they can accommodate the large storage system and take advantage of the truck stop fueling infrastructure. The greater energy density of LNG makes it more practical than CNG for long-haul trucks that can accommodate larger fuel tanks.

The advantage of LNG is that it offers an energy density comparable to diesel. This extends the driving range and reduces the need for refueling (important when refueling opportunities are scarce). The main disadvantage is the high cost of cryogenic storage on vehicles.

Liquid natural gas (LNG) UPS fleet vehicle being fueled. (Photo courtesy of UPS)

LNG ADVANTAGES OVER CNG

Liquid natural gas (LNG) UPS fleet vehicle being fueled. (Photo courtesy of UPS)

LNG ADVANTAGES OVER CNG

•

Greater driving range

•

No expense for compression

•

Much smaller storage requirement

•

Lighter in weight.

Other available technologies include gas-to-liquids (GTL), which converts natural gas into diesel and can be used in an existing vehicle fleet and dispensed through the existing refueling infrastructure.

HYDRAULIC FRACTURING (FRACKING)

Hydraulic fracturing (fracking) technology is responsible for major increases in U.S. natural gas reserves. During a fracking operation, a large amount of water is mixed with sand and/or chemicals and then high-pressure injected into rocks—in essence artificially producing hydraulic fractures that otherwise form naturally. These fractures (whether artificial or natural) create conduits for gas and petroleum to migrate to reservoirs where they can be collected.

While the procedure frees up vast amounts of natural gas and petroleum that would have been inaccessible, it is controversial. Opponents point to the often adverse environmental impact such as groundwater contamination, fresh water depletion, risks to air quality and migration of fracking chemicals to the surface. All of these have the potential to cause health problems. Also, fracking has leveled the landscape in mountainous areas, permanently affecting aesthetics. For these reasons, fracking has either been suspended or banned in some countries.

NATURAL GAS FLEET VEHICLES

Some fuel-intensive fleets have been using natural gas for years. It makes sense since fleet vehicles that travel short distances are refueled in a central maintenance location and also since the large number of vehicles makes it more cost-effective to convert or purchase vehicles.

Natural gas as a transportation fuel is growing. More than 20 percent of all transit buses are fueled with natural gas. Transit buses are the largest users of natural gas for vehicles. The fastest growing NGV use is for waste-handling vehicles. NGV Global, the international NGV association, estimates there will be more than 50 million natural gas vehicles worldwide within the next 10 years, or about 9 percent of the world’s transportation fleets.

In the U.S., natural gas powers:

•

More than 11,000 transit buses.

•

Nearly 4,000 refuse trucks.

•

More than 3,000 school buses.

•

About 15,000-17,000 medium-duty vehicles with a wide variety of work applications (such as airport shuttles).

•

More than 30,000 light-duty vehicles in federal, state, local government and private fleets.

•

Many of these vehicles were formerly powered by diesel and later retrofitted for natural gas.

DIESEL-TO-NATURAL GAS CONVERSION

Even though NGVs have the same basic design requirements as diesel vehicles, diesel-to-natural gas conversion requires some engine and control system modifications. These changes are mainly to the engine, fuel tank and frame.

Engine. When the engine in an NGV is started, natural gas flows from the storage cylinders into a fuel line. As the fuel approaches the engine, it enters a regulator, which reduces the pressure. Then the gas feeds into a fuel- injection system, which distributes the fuel into the cylinders. As with a traditional fuel vehicle, sensors and electronic controls adjust the fuel-air mixture so that the gas burns efficiently. But an NGV engine needs high-compression aluminum pistons, nickel- tungsten exhaust valve seats and a catalytic converter that is methane-specific. The following specific engine modifications are recommended:

•

Compression Ratio. Most diesel engines have a compression ratio of between 16 to 1 and 18 to 1. CNG engines work best between 10 to 1 and 12 to 1. This requires either new or modified pistons. The combustion chamber must allow for correct air-fuel mixing.

•

Spark Plugs. Diesel engines have fuel injectors instead of spark plugs. So injectors need to be replaced with spark plugs. They also might require an insert that goes through the valve cover. NGVs require a higher spark plug voltage than a diesel engine, and spark plugs tend to wear faster.

•

Valves. Since natural gas is a dry fuel, valve seats in a converted engine need to be hardened to prevent abnormal wear. Older engines need valve guide seals to prevent the engine from drawing oil into the combustion chamber.

•

Thermal Management Components. Spark-ignited NGVs run hotter than diesel vehicles. This means they may require upgraded thermal management components such as larger oil coolers, larger radiators and heat shields to protect exhaust components.

•

Catalytic Converter. Nearly all engines will need a catalytic converter in order to satisfy emission regulations. One of the only exceptions is lean-burn NGV engines which, if carefully engineered, can meet regulations without a converter.

•

Engine Management System. The configuration depends on a number of factors such as exhaust emissions requirements, fuel efficiency targets, durability expectations, the level of vehicle technology and peripheral device controls (i.e., cruise control).

Fuel Tank. A CNG vehicle has a fuel storage system that is composed of lightweight cylinders that attach to the top, bottom or rear of the vehicle. A typical design includes three lightweight cylinders contained within a fiberglass shell and foam to protect them from impact. The size and shape of the shell is close to a conventional diesel tank.

Frame. In order to create space for fuel storage in some NGVs (mostly LNG vehicles), modifications in the suspension might be necessary. For example, a semi-trailing arm suspension may replace the lateral-link suspension that is standard in diesel-powered vehicles. This creates more open space in the undercarriage without affecting the quality of the ride. Where NGVs create more space by eliminating the tire and jack, they are equipped with run-flat tires to compensate.

This conversion also requires a significant investment, which can be amortized across a large number of fleet vehicles—the reason current conversions have been limited to larger fleets.

Jeff Yapp, vice president of Global Automotive Engineering & Operations for UPS, says that while UPS continues to look at all available technology, including conversions, it does not have any retrofitted vehicles currently in service.

THE CUMMINS WESTPORT NATURAL GAS ENGINE

The Cummins Westport ISX12 G is a natural gas engine with a larger displacement than earlier versions. The ISX12 G was designed for a variety of heavy-duty vehicles, including regional-haul truck/tractor, school bus and refuse applications.

The ISX12 G engine is based on the Cummins ISX12 diesel engine platform and operates exclusively on 100 percent natural gas, which can be carried on the vehicle in either compressed (CNG) or liquefied (LNG) form. The ISL G also can run on renewable natural gas (RNG). It incorporates the company’s proprietary spark-ignited, stoichiometric combustion with cooled exhaust gas recirculation (SEGR) technology, and its spark ignition and simple 3-way catalyst (TWC) after-treatment. The design features displacement of 11.9 litters and up to 400 hp and 1450 lb-ft of torque. The recommended maximum GVW for line-haul applications is 80,000 lbs (36,287 kg). Recommended gearing is 1400 rpm to 1450 rpm at cruise speed to optimize fuel economy.

The engine also meets 2013 U.S. EPA and California Air Resource Board (ARB) emission standards, as well as the 2014 EPA and U.S. Department of Transportation fuel economy and greenhouse gases regulations.

OIL SELECTION & ANALYSIS

Current manufacturers of natural gas engines include Westport, Cummins- Westport, Detroit Diesel and Volvo. Most engine and lubricant manufacturers agree that lubricants for NGVs must protect against a broader range of conditions than diesel engine lubricants.

“Regular maintenance is just as important as it is with any other diesel engine to ensure optimal performance,” says Corey Taylor, senior HD technologist and grease technology manager for BP Lubricants USA Inc. “Not only does an on-road natural gas engine run on a different fuel, it also often requires a specialized engine oil. The primary challenge I see as it relates to engine oils pertains to companies with mixed fleets. As they migrate, there is a need to manage inventory of two fuels and two oils.”

NG oils must handle increased nitration, more so than diesel, due to higher combustion temps. Another oil degradation consideration, especially applicable to NGV engines, is sulfated ash content.

Castrol offers two products specifically formulated for on-road natural gas engines: Duratec NG (with a mineral oil base) and Duratec ES (a full synthetic). According to Taylor, ES is proven to safely extend drain intervals to 1,200 hours. “It’s truly a game-changer as it can increase efficiency through longer drain intervals, less lubricant usage, more uptime, less overall cost and less waste oil,” he says.

OIL ANALYSIS TESTS

Ray Hodges, CLS/OMA, senior data analyst for Analysts, Inc., says that his company has seen an increase in natural gas engine oil samples. He attributes this to the increasing number of trucks being converted to natural gas.

While monitoring the condition of the natural gas engine itself can reveal stresses on the lubricant (i.e., vibration analysis, pressure-time curve and pressure-volume curve), monitoring the lubricants directly is often more cost-effective and precise.

“Common problems in natural gas engines that are identified by oil analysis include overheating, overextended oil drain intervals, imbalance in the air/fuel ratio, coolant leaks, using the wrong type of oil and contamination from outside sources,” Hodges explains. Also NGV engines can burn much larger quantities of lubricating oil than their diesel counterparts during operation. This needs to be accounted for during oil analysis.

There are eight standard oil analysis tests that are included in most regularly scheduled maintenance operations for NGVs.

Viscosity. Viscosity should be measured at 40 C and 100 C. The results are then compared with new oil specs. An increase in viscosity can indicate nitration, oxidation and/or increased insolubles/contamination. A decrease in viscosity can indicate water ingress and possible shearing of VI index improvers.

Acid Number. The general rule is to test NGVs for acid number (AN) and diesel vehicles for base number, primarily because the additive volume in NGVs is generally lower. Increased acid levels in NGVs are an indicator of contamination, nitration and/or oxidation. As the AN increases, the viscosity generally increases as well. The oil’s useful life is usually over when the AN doubles.

Base Number. BN is usually only tested when the vehicle is designed to use both diesel and natural gas and diesel is used more than half of the time. This test can evidence additive depletion. The general guideline is that a lubricant is no longer providing adequate protection when the BN drops by half.

Nitration and Oxidation. Both nitration and oxidation occur naturally in NGV oils and are a big problem. While oxidation occurs in nearly all lubrication systems, nitration is much more prevalent in NGV engines and can lead to problems as severe as oil solidification. The two main conditions that need to be carefully controlled in order to prevent excessive nitration are the operating temperature and the air-to-fuel ratio. While only half of diesel engines are tested for oxidation/ nitration, nearly all natural gas engines require it.

Glycol Contamination. The presence of glycol indicates corrosive coolant leaking into the engine, which will lead to reduction in the oil barrier and engine failure fairly rapidly. Some lubricants may contain glycol in their original state, so it is important to know the new oil specifications before testing.

Water Contamination. Water contamination can be an issue for NGV oils in engines with high flow rates and turbulence because foaming can be initiated with a relatively small amount of water. This is especially true in engines with low oil temperatures (which effectively prevent the water from evaporating).

Insolubles. When insolubles such as dirt, wear metals and carbon particles have not been filtered out, they can lead to foaming and increased viscosity. Insolubles can be measured via precipitation and particle counting.

Sulfated Ash. Since NGV engines usually operate at higher temperatures than diesel engines, they tend to form deposits such as varnish, sludge and ash, which remain after the oil is burned. The varnish and sludge are controlled by the detergent/dispersant additives; however these additives tend to leave an ash residue. Given this, the additive concentrations must be high enough to help prevent valve recession (premature valve seat wear into the cylinder head) but low enough to prevent harmful deposits.

In addition, NGV engine manufacturers recommend spectrochemical analysis to determine the levels of wear metals and the concentration of additive elements. The results indicate the wear rates of engine components and degree of additive depletion.

Taylor explains that currently there are no industry-wide performance standards for natural gas engines, but there are engine and bench tests specified by natural gas engine OEMs, thus approvals are OEM-specific. He adds, “For used oil analysis, we measure the same set of parameters as for standard diesel engine oil (i.e., wear metals, coolant contamination, etc.), with a particular emphasis on oxidation, nitration and total acid number. As with standard diesel engine oil, we strongly recommend the use of a qualified used oil analysis program to ensure proper engine and oil performance, particularly when extending drain intervals.”

NATURAL GAS PASSENGER VEHICLES

Natural gas passenger vehicles (NGVs) are still relatively uncommon for a number of reasons—the most important being that it’s not that easy to find a refueling station. Despite this, two car companies are spearheading the effort.

Honda was the first manufacturer to offer a dedicated NGV (it can only run on natural gas). Its Civic GX sedan comes with a home refueling station, which evens the refueling playing field with fleet vehicles. It is generally available only in the western U.S.

DaimlerChrysler has a B-class Mercedes (B-200) that runs on both diesel and natural gas. The company calls its contribution an NGT (for natural gas technology). It can go 620 miles on a single fueling—186 miles using natural gas and 435 miles using diesel. This car is available only in Europe.

One of the biggest complaints about NGV passenger cars is that, because of the large gas cylinders, they have much less cargo and trunk space than their gasoline counterparts. These cylinders can be expensive to design and build, which contributes to the higher overall costs. Another drawback is that the driving range is about half that of a gasoline-powered vehicle. However, if the price of oil continues to rise, experts expect the passenger NGV market to widen.

THE SHIFT CONTINUES

The list of major U.S. fleets shifting to NGVs is growing. FedEx officials say the company’s interest is spurred by reduced fuel costs and the growing number of refueling stations along long haul routes. In 2012, the business unit of FedEx Corp. began testing two new tractors powered by Cummins- Westport LNG engines. The tractors are being used as part of the company’s regular line haul operations and run about 1,000 miles per day between service centers.

“The shift to natural gas engines has been underway for a few years, most notably within vocational and refuse fleets that return to a central depot at night,” Taylor says. “As the CNG/LNG refueling infrastructure begins to expand across the country, we expect there to be a similar trend among long haul fleets.”

Jeanna Van Rensselar heads her own communication/public relations firm, Smart PR Communications, in Naperville, Ill. You can reach her at jeanna@smartprcommunications.com

Jeanna Van Rensselar heads her own communication/public relations firm, Smart PR Communications, in Naperville, Ill. You can reach her at jeanna@smartprcommunications.com.