High-performance lubricants: Cost vs. performance

Mike Johnson | TLT Best Practices May 2010

Despite higher prices, performance products can actually lower the net use cost to your organization.

KEY CONCEPTS

•

Lubricants can be categorized as either conventional, high-performance or specialty products.

•

High-performance lubricants offer the end-user the hope of lower total maintenance and/or energy costs.

•

Business management should look to reduce the total cost of operations or else the value derived from improved performance will be lost in the debate over product price.

From the purchasing manager’s viewpoint, there can be a fair amount of angst associated with the purchase of high-performance lubricants. This is driven by the combined issues of proof of performance and value vs. the inevitable spike in purchase cost. Proof of performance can be difficult. It is impossible to see into the invisible gap between the lubricant surfaces in the machine to judge precisely what the material is doing for its obvious price premium.

Much of the proof of improvement is based on evidence such as reduced heat, wear debris, energy consumption and product consumption. Ultimately, the end-user takes the risk up front in the form of added cost of operations on the promise that he or she will earn that premium back and add more value over time in the form of reduced cost of operations.

At the same time, the total cost of lubricant purchases is truly irrelevant to the plant’s annual profitability. The differential cost between the stuff in use vs. the stuff that could be in use can sometimes be significant, but in the end it is still irrelevant. Differences in use cost are a different story.

This article explores the general differences in conventional, high-performance and specialty products, as well as the impact of the net lubricant purchases on plant profits. Additionally, we’ll present use cost vs. purchase price and consider a few possible drawbacks that could accompany a switch to HP products.

CONVENTIONAL, HIGH-PERFORMANCE AND SPECIALTY PRODUCTS

The only thing that is clear between these three categories is that nothing is at all clear, particularly to the end-user. How could it be when the basis of the performance differential is too often a data point on a data sheet that is described by an obscure notation such as “ASTM D943, hours to termination: 8,000.” This value is one of the well-used parameters for grading the quality of hydraulic and circulating oils, but it doesn’t tell the end-user that the lubricant could last four times longer under the same operating conditions for just three times the price. More important, the parameter doesn’t reveal that the proposed material could provide a use cost well below the current product.

Conventional lubricants. To differentiate in general terms, conventional lubricants meet the “keep it full” requirement. These products are built to deliver above the minimum allowable technical specifications, the performance is measured and the results are published (albeit in tribo-speak), and then the products are priced to earn the sale. This model represents how most manufacturers procure lubricants and, accordingly, the model serves a large market interest.

Following the Pareto Rule, 80% of the machines that operate reliably without special attention can fare well using conventional lubricants. Even with these applications, there are process improvements that can help to reduce cost and improve reliability. Extended lubricant life cycles, reduced deposits, improved machine performance (less leakage, fewer valve repairs, less wear debris, better repeatability, etc.) and optimized use cost can all be achieved with improved handling and contamination control strategies, regardless of the relative quality of the product. Similarly, labor for grease replenishment can be optimized through application of long-accepted calculations for application-specific frequency and volume.

High performance products. It is a common perspective for representatives of any company to suggest that their product line offers superior performance vs. all competitors, but conviction alone does not secure superior performance. HP products are designed to thoroughly exceed the minimum allowable technical standard for a given application. They are manufactured with specialized raw materials for proprietary, sometimes patented, lubricant recipes. The materials are designed to offer enhanced performance capability in the form of improved oxidation and deposit resistance, improved surface protection (wear resistance, nanoscale surface enhancement), improved long-term viability (greases), etc., vs. conventional product performance. Given that the cost of raw materials varies with raw material performance capability, it is inevitable that the finished product cost basis and market price will be higher.

Common HP product examples include gear oils and greases incorporating solid film agents (synergistic metallic-molybdenum blends, graphite, borates), hydraulic oils manufactured with severely hydrotreated basestocks and ashless antiwear agents, turbine oils manufactured with hydrocracked stocks and deposit-resistant oxidation inhibitors. Following the Pareto representation from earlier, the balance of plant applications (20%+/-) would be well served with HP lubricants. Allocation of the products should be determined by a combination of machine performance history and machine criticality status.

Specialty-performance lubricants. These products are designed, built and selected to be physically and chemically stable in the production environment. These materials are required to operate with minimal degradation in temperature extremes, under vacuums and exposure to contaminants that would quickly destroy other lubricants.

Some examples include:

•

Lubricants operating under the dome must be radiation resistant.

•

Lubricants operating in components in the vacuum of space (-200 C near earth temperatures (

1)).

•

Lubricants operating in a chemical-rich environment such as oxygen or CO

2 compressor operation.

•

Machines that pump natural gas and light hydrocarbons require lubricants that will not absorb (mix with) the gas during transmission.

Each of these could be considered a highly specialized requirement demanding unique properties from the lubricant for optimum machine performance. Maybe 1% of plant applications require a specialty lubricant. The price interval between the specialty and commodity product prices can routinely be as high as 100:1.

LUBRICANT COST ON ENTERPRISE PROFITS

Performance lubricants are often not considered for use because of price objections. Although cost control is a legitimate requirement for all businesses, limiting the use of a lubricant material because the price is higher than other similarly graded products is shortsighted.

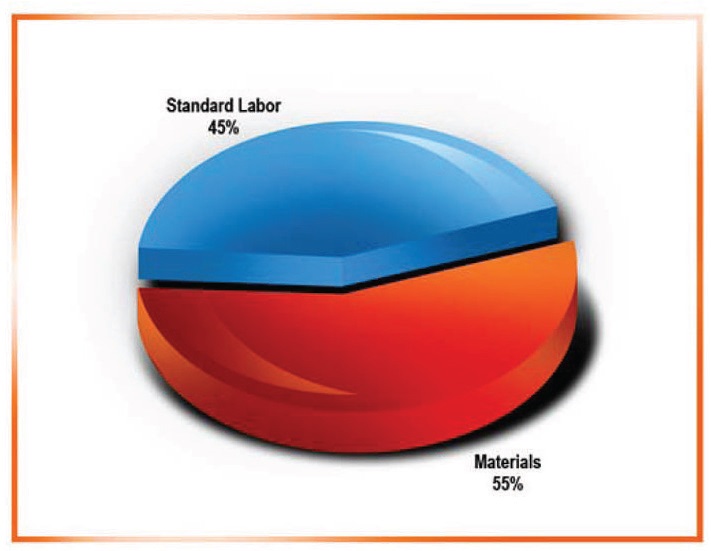

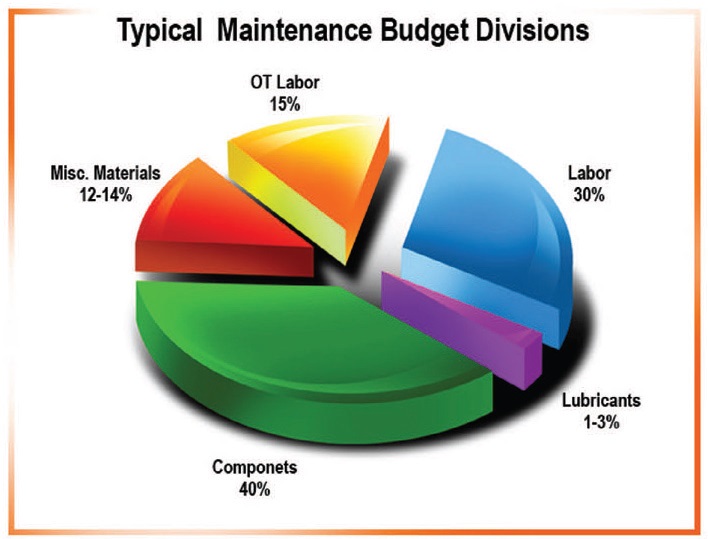

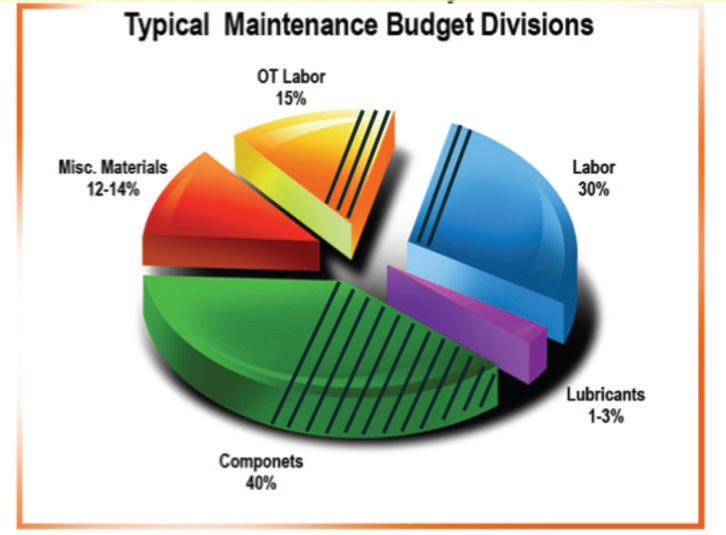

To put the whole lubricant cost consideration into perspective, consider lubricant purchases as a percentage of the total maintenance expenditure. Maintenance costs range from 5% to 15% of a plant’s cost of manufacturing, depending on the industry. As shown in Figure 1, the balance between labor and parts charges is nearly even. The labor portion, which accounts for roughly 45% of the total, includes charges for both salaries and wages. Lubricant application labor represents 3% to 5% of the standard wages charge. As shown in Figure 2, the overtime portion of the wages budget represents 12% to 15%. Overtime wages pertain to time someone is held over or called in to complete a repair. Collectively, the plant’s lubrication requirements effects 15% of the labor budget and directly impacts at least 5%.

Figure 1. The percentage breakdown of an industrial maintenance budget.

Figure 1. The percentage breakdown of an industrial maintenance budget.

Figure 2. The incremental breakdown of the labor and materials portions of an industrial maintenance budget.

The materials portion of the budget reflects cost for items that the purchasing department buys to keep the buildings in good shape and the equipment running. Indirect materials portion represents 12% to 14% of the total budget. This includes items that are needed to operate but are not placed directly in the production process (pencil sharpeners, light bulbs, hand towels, etc.). The largest portion of the materials budget goes to direct plant and equipment maintenance and averages around 40%. About half of that, 20% of the total, will be earmarked for machine-related requirements.

Lubricant purchases represent only 1%-3% of maintenance expenses. For businesses that use lubricants as a process fluid (heat tracing, rolling, cutting, broaching, quenching, grinding, etc.), the value is closer to 3%. For businesses that only use lubricants to protect load-bearing surfaces and provide hydromechanical functions, the value is closer to 1%.

Figure 3 shows the portion of the budget directly impacted by lubricant expenditures, which represents about 35% (20% from parts replacement, plus the 15% from lube program routine and overtime-repair labor). The cost-to-cost leverage factor for lubricant savings opportunity vs. lubricant expenses is an astounding 35:1. Investment in either process or product type improvements can produce returns at several hundred percent of the investment with just a little bit of effort.

Figure 3. Portions of the maintenance budget directly influenced by the plant lubrication practice.

Figure 3. Portions of the maintenance budget directly influenced by the plant lubrication practice.

The budget numbers will float up and down depending on how closely the site is tuned into long-term care and reliability management.

From personal experience it is clear that these values and relationships mean absolutely nothing unless those involved in business management are focused on

cost control (vs. price control). Several years ago, while managing the southeast region of a HP lubricant manufacturer, I visited a customer site for a large, high-profile food producer. The maintenance manager for one division of this large plant wanted to adopt the products and in-plant service programs offered by my company but was denied by the purchasing agent assigned to MRO purchases. The products had served the site’s container production department quite well over a period of years. The maintenance manager from the container plant had a file full of documentation that he developed to justify continued use of lubricants in his area. With documentation in hand, the local representative and I visited the purchasing representative to have the value discussion, and we were turned down flat. The bottom line was that the price was five times the cost of products currently in use. This was a penny-wise and dollar foolish decision, but the purchasing agent had clear motivation to suppress every incidence of possible increases in pricing, regardless of the implications.

USE COST VS. PURCHASE PRICE

Another way to view the value of HP products is through use cost. The product’s use cost is a reflection of what it costs to actually use the product. Consider that there are only a few applications where HP mineral and synthetic-based lubricants are the products of choice by both OEMs and end-users alike. Plant compressor operation is one such instance, so compressor lubrication is a good example.

Most new industrial air compressor installations are screw type units providing plant air service. There are many manufacturers with slight differences between makes and models, but they all have a common job to perform. From a tribological perspective, a screw compressor is a circulating system providing a continuous flow to two sets of bearings and a timing gear. The oil is hot, wet and dirty and, therefore, requires a cooler and filter to condition the oil. Screw compressor oils are built with the same design interests as turbine oils. Continuous flow and continuous shaft speeds means full-bodied oil films can be maintained to provide surface separation. Therefore, AW and EP agents that create organo-metallic tribofilms at rubbing surfaces aren’t needed.

This hasn’t always been the case, though. In the early days of the screw compressor applications, conventional hydraulic, turbine and auto-transmission oils were widely used with varying degrees of success. Regarding use cost, let’s consider the use of a high-performance screw compressor oil vs. an AW hydraulic oil at the same viscosity grade (ISO 32). In both instances, the cold flow properties are adequate for nearly all geographical regions. Any operation working with an unacceptable climate condition for the mineral oil wouldn’t really have a choice in the matter anyway. Both can provide the lubricity, EHD fi lm formation, moisture release and required heat transfer rate. There is a potential for significant differences in both deposit formation and lubricant life cycle. Both concerns are the function of the natural resistance to oxidation provided by the basestock and the quality and concentration of oxidation inhibitors in use. At 100 C +/-discharge temperatures, conventional mineral oil-based lubricants do not last as long as their synthetic-based counterparts.

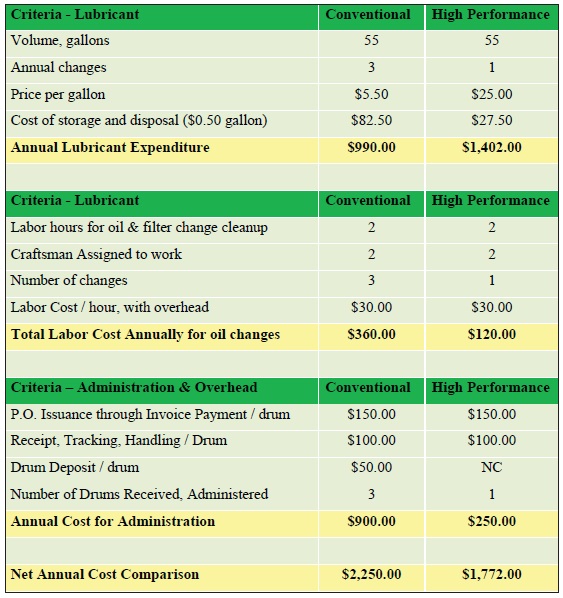

For a use cost contrast between the two options, consider the example in Figure 4.

Figure 4. A simple cost analysis between conventional and high-performance lubricants using common conservative cost factors.

Figure 4. A simple cost analysis between conventional and high-performance lubricants using common conservative cost factors.

Factors not mentioned in this comparison but that contribute nonetheless to the value proposition include:

•

Reduced power consumption (often enough to pay for the cost difference).

•

Reduced long-term effort to manage deposit control.

•

Reduced downtime from change events.

•

Reduced dependence on rentals from curtailed air production for changes.

•

Extended machine life cycle/reduced repairs.

This is a very simple comparison but demonstrates the point that a more expensive choice can sometimes be the less costly choice.

DRAWBACKS

It is possible for HP products to become overused. When this happens, value is destroyed and the healthy argument for economy through superior quality is tarnished. If the supplier is being attentive and truthful, applications will not grow without careful observation for risk to seals, o-rings, polycarbonate components, coatings and paints, sight glasses, feed lines and other plastic parts around the selected change. In the absence of careful application, it is possible to create a compatibility failure with an HP product that degrades machine health.

The biggest threat to loss of value comes from the risk of leakage. An HP product does not lubricate the floor better than a conventional technology product. If the system has leak-integrity and the polymers in use are compatible with the lubricant raw materials, then this risk is no different than with conventional products.

SUMMARY

Substantial differences exist between conventional, high-performance and specialty lubricants, even when the viscometric properties are similar. Measurement and interpretation of the differences is not always easy. Differences in the expected longevity, rate of deposit formation, film strength and wear resistance are common points of interest for comparison sake.

Even though they carry higher prices, performance products can have lower net use cost. There are several charges incurred with the purchase, handling, storage, use and removal of a lubricant that should be considered in a use cost discussion. Drawbacks to the use of an HP lubricant include issues with incompatibility and seal degradation that can initiate leakage. HP products don’t do a better job lubricating the plant floor than conventional technologies.

REFERENCE

1.

“Typical Operating Temperature Ranges for Selected Spacecraft Components,” Table 11-43,

Space Mission Analysis and Design, Wertz and Larson (eds) Kluwer, 1999.

Mike Johnson, CLS, CMRP, MLT, is the principal consultant for Advanced Machine Reliability Resources, in Franklin, Tenn. You can reach him at mike.johnson@precisionlubrication.com

Mike Johnson, CLS, CMRP, MLT, is the principal consultant for Advanced Machine Reliability Resources, in Franklin, Tenn. You can reach him at mike.johnson@precisionlubrication.com.